Last week, I detailed my plans for an upcoming credit card signup. In it, after looking through the current rules and best practices for each bank, I figured out which cards I was planning on applying for

The cards I applied for this credit card signup

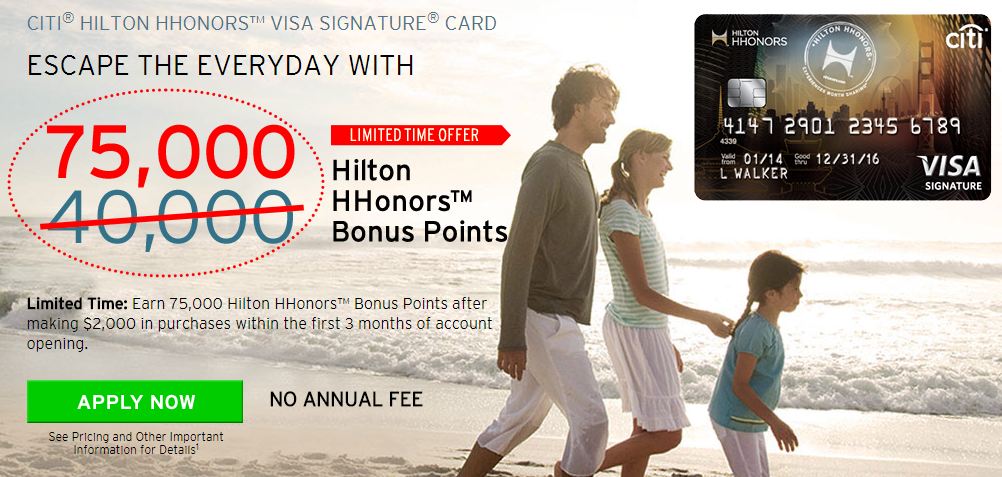

- Citibank Hilton HHonors 75,000 point card. Both Carolyn and I have this card (multiples), but we haven’t open or closed a card in the last 18 months, so we should be able to get the bonus again. Since this bonus is nearly twice as much as the normal amount, it definitely qualifies as a good one! I wrote about this card a few weeks ago – New limited-time 75,000 Hilton HHonors point credit card offer

- American Express Starwood Business card: 30,000 points (up from the normal 25,000 points). I got the SPG personal card with my first credit card signup, but with the business cards, you can get the bonus once every 12 months. We were originally targeting our SPG points for a stay at the Swan or Dolphin resort at Disney World, but now I’m not sure.

- After posting about the recent crackdown on people with many signups by Chase, I got an email comment suggesting that they might still be able to get Chase Ink (business) cards. So I may apply for one of those as well.

- Bank of America Alaska Airlines cards. I am not sure if I’ll try applying for multiples or not (I know some people have gotten 4 or 5 in a day, but I’ve heard they’re cracking down on that), but we both will probably get one personal card, and I may get a business card as well.

August 2015 credit card signup results

- Citi Hilton HHonors 75,000 point offer. Carolyn instantly approved with an $18,000 credit limit. I was pending, but after calling into the Citi reconsideration phone number, the agent told me that given the other Citi cards I already have, they were at the maximum total amount of credit they were willing to give me, so we moved some credit around, and I was approved with an $8000 limit

- American Express SPG Business card – instantly approved

- Carolyn was instantly approved for an Alaska card. I detailed my problems trying to apply for 2 Alaska cards at the same time, but I believe both of mine were approved. One was instantly approved, and the agent on the phone said that the other one was approved too, but still going through processing. It definitely wasn’t rejected as a duplicate.

- I ended up not applying for any other Business cards (Chase or Alaska)

So that would be 6 cards, which should give 255,000 points and $200 in statement credits after meeting $12,000 in spending in the next 3 months. Sounds like I got my work cut out for me, especially if other portals follow Top Cashback’s lead in limiting the amount of cashback that you can get for American Express gift cards!

I don’t have individual affiliate links to these cards, but most of these cards are accessible through my links at creditcards.com. You don’t have to use my links if you’re signing up for credit cards (and you should always make sure that they represent the best deal), but if you do, I appreciate it!

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Just called this # 866-422-0458. I have the Hilton card, got 50,000 via promo a month ago. Mentioned 75,000 offer and if they could match. They said no, no way. She confirmed she was aware of the 75k offer but strictly said, the promo you signed up for was different, therefore you cannot qualify for a higher offer. Kinda sucks.

That stinks. You might want to try and call back later – lots of times if you get a different agent, you might have a different number

Hi. I have a question about the citi Hilton. I have had this card for a while. What exactly is Citibank’s churning rule for this card. I got THIS card at least 5 years ago but did get the citi the Citi Thank You Premeir about 6 months ago. Will I get approved and qualify for the bonus?

Well, I can’t say if you’ll get approved or not, but as long as you haven’t opened or closed a Citi Hilton card in the past 18 months, if you do get approved, you should get the bonus. If you do apply and use my Citi 75,000 Hilton link, I appreciate it!

I’ve been reading about how like you, frequent travelers rack up the credit cards but I’ve yet to find an answer to my question/thought. If they waive the membership fee for the first year, do people cancel their card before a year is up or do you guys have a ton of credit cards? Just curious. Thanks.

That’s a great question and is probably worth a whole separate post that I’ll try to write next week. The short answer is “it depends”. Many cards I do cancel, some don’t have an annual fee at all, and there are some where the ongoing benefits are worth paying the fee

Excellent. I look forward to your post, whenever you have time for it.

I’ve yet to get anyone “move credit around”. Can you share a bit of info on how you get them to do it?

Specifically, I am talking Capital One or Citi. Chase hates me because too many cards, etc, so I think they are out of the question.

The lady I talked to just volunteered it. She called it something like a “credit line adjustment”. If you can share some more details of how many cards you have or what your total credit limit is maybe by email at dan at pointswithacrew dot com if you don’t want to post them on the Internet, I can see if I can help shed some light on it

If AMEX no longer works as an option, you might have to drive to your local Simon Mall. They seem to be a popular way to MS to Bluebird/Serve/Redbird.

Hi Dan,

I just applied for my 2nd Amex card in the last month. About 3 weeks ago I applied for and got approved for the Amex everyday preferred. I applied for a got rejected for the SPG Amex. Is there a way to get this reviewed for approval? Any ways to improve my chances with a review process?

Cheers!

Greg

There seems to be a limit of 4 total Amex cards that you can have at one time. It sounds like you haven’t hit that limit, so my suggestion would be to call the Amex reconsideration line at 800-567-1083

Hi! I found this amazing place for beginners! I see that there is a list of cc you applied for in August and I’m hoping I can replicate you. That is great cause I can follow you! I do have one question though. I would love to travel, so as a beginner what cards should I keep open to hold all my points and how would I pay off $12,000 in 3 months. Can I get away with using 0 to very little amount of my actual money?

Tina – I don’t recommend just following what I am doing. I’ve been doing this a long time and have different goals than you probably do. I would recommend reading the Beginner’s Guide, and also Begin with the End in Mind.

Thanks!