Today, thanks to the Points with a Crew Slack channel, I learned that Allegiant had recently entered into an agreement with Bank of America to offer the Allegiant World MasterCard. Co-branded airline credit cards are usually targeted at frequent fliers of said airline, and most of Allegiant’s customers are infrequent fliers, so you can understand my confusion as to why they would create their own credit card. Let’s dive into the perks of the card, and see if the Allegiant credit card worth investing in.

Earning Structure

- 3 points per $1 on Allegiant purchases (air, hotel, car rental and attractions)

- 2 points per $1 on qualifying dining purchases

- 1 point per $1 on all other purchases

(READ MORE: Allegiant opens 17 new routes; adds new destination)

Bonus Offer

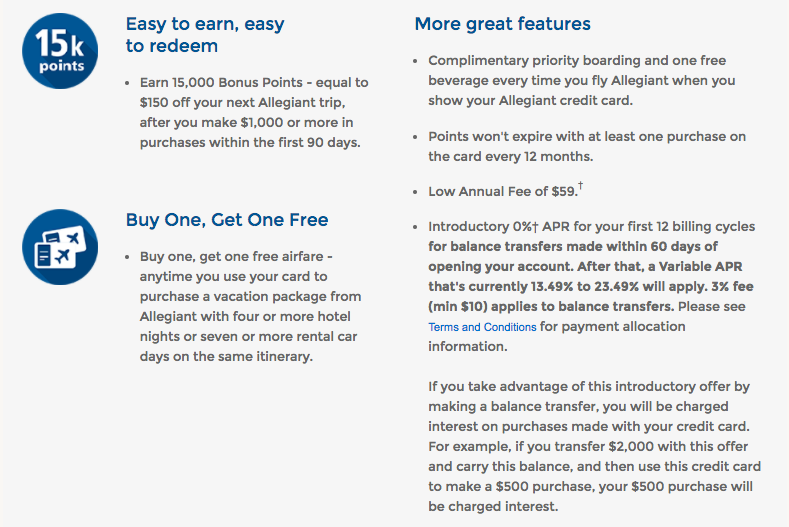

If you spend $1,000 within three months of opening the credit card, you’ll earn 15,000 points, good for $150 off any Allegiant travel. This ratio values Allegiant credit card points worth one cent apiece.

Other Notes

- $59 annual fee

- 3% foreign transaction fee

- Buy one, get one free airfare (details below)

- No blackout dates

- No destination restrictions

- No minimum points redemption

Does it make sense?

In a word, no. Even the most frequent Allegiant flier is likely to get very little out of this card. Let’s suppose you spend $7,500 a year on this card in the following way:

- $500 on Allegiant (1,500 points)

- $2,500 on dining (5,000 points)

- $4,500 on everything else (4,500 points)

At the end of the year you’ll have only earned 11,000 points, good for $110 off Allegiant airfare. There are LOADS of other cards (most with lower annual fees!) that will earn you more points with more use!

Take the Chase Freedom Unlimited, which earns 1.5% cash back on all purchases. That card will earn you 11,250 points when you spend the amounts above. Those points can either be redeemed for $112.50 cash back or for 11,250 Chase Ultimate Rewards points if you have one of their premium cards, like the Chase Sapphire Reserve.

(READ MORE: Chase Ultimate Rewards – 5 reasons I think they’re the best miles out there)

Or, maybe the Citi DoubleCash is more your speed. For the same spend above, you’d earn $150 cash back. That’s 36% more cash back to spend on an Allegiant flight, or any other airline of your choosing for that matter.

Allegiant Credit Card Conclusion

You learn something new every day. While it’s good to know the the Allegiant credit card exists, it’s definitely not worth your time. Even with the buy one, get one airfare deal, this card gets a hard pass from me.

Is this a card you find compelling? Let us know below if you think we’ve missed something!

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Allegiant is the most miserable airline in the USA. They’re constantly delaying, sometimes even for days at a time. However, the control certain direct routes (South Florida to Asheville) and you’re forced to travel with them.

If this card could make Allegiant flights operate on time for me, I might be in. Might.