So in the first part of this series, we talked a little bit about how applying for (and having) multiple credit cards affects your credit. The short answer is that in the “happy” scenario, where everything goes well, it won’t affect your credit score very much at all.

But there are a couple of scenarios when it probably doesn’t makes sense. So when would I NOT recommend getting involved in travel hacking?

- If you aren’t sure what you’re doing. The fastest way to screwing something is up is not having a good idea of what is going on. Having said that, if you’re looking for help or advice, you can check out the Beginner’s Guide, or also feel free to contact me on Share or . I’m always happy to help out. The most important thing is that YOU are comfortable with what you’re doing. Start slow, and only participate as much as YOU feel comfortable with.

- If you have outstanding balances on any existing cards, or you can’t or don’t pay off your balances in full each month. Any gains you get from travel hacking will be more than eaten up by interest charges.

- If you’re not organized enough to track your spending. We’ll talk a little more about this in a future post, but not being organized will cause you to do things like miss payments (racking up interest / late fees), or not hit the spending target on a CC (causing you to not get the bonus). I mean, I consider myself pretty organized (you should SEE my spreadsheet 😀 ) but I’ve had a few problems with this anyways

- Another time I would recommend waiting would be if you have any impending big purchases, like a car or house. Even a slight dip in your credit could cost you several points on your interest rate, and you don’t want to have to pay that premium for the next 30 years…

Regarding that last point, I’m reminded of a story someone told me the other day. Several years ago, the US Mint was trying to get the new Presidential $1 coins into circulation, so they had a promotion where you could order them online for free shipping. This guy mentioned that he had gotten a great deal on a cash advance from his credit card, so he took a big portion of his credit limit ($5000? $10000? I’m not sure) and bought the dollar coins, then used that money to buy a CD. The balance transfer fee was 1% and the CD was yielding 3% (numbers totally made up to tell the story but I’m sure they’re in the ballpark), so he figured this was a risk-free way to earn a few hundred dollars.

- The Basics

- How does signing up for credit cards affect your credit score, Part 1

- How does signing up for credit cards affect your credit score, Part 2

- Meeting spending totals on credit cards

- Tracking signup bonuses (and making sure you GET them!)

- Earning miles through shopping portals

- The truth of the travelers's triangle: The relationship between time, price, and location

- Begin with the end in mind

All was well, until his car broke down and they had to buy a new one. As we discussed last time, one of the more important factors in your credit score is how much of your available credit you’re using. Because all his was tied up in the CD, his score dropped fairly significantly, and he was not able to get a good rate on his car loan. There went the hundreds of dollars he was making. In the end, he was able to refinance after his CD matured and was not terribly worse for the wear, but it is a good reminder that if you have any upcoming major purchases, you should wait to start this game. It took a long time for us to refinance our house, for various reasons, but it finally closed in December 2012, and I did my first major credit card signups in January of 2013.

Okay, so enough about that. Assuming none of the gotchas above apply to you, where do you start? Do you even know what your credit score is? You can get your report periodically from the government, and there are other services out there that purport to offer “free” scores, usually with a catch where you get charged if you don’t cancel on time or something like that.

One place that I have found and that I use is called Credit Sesame.

I signed up for them back about a year ago and have been very pleased. You do have to give basic information to them, as well as answer questions to verify your identity, but the important thing is that you do NOT need to put in a credit card, and there is no charge. I believe they make money from providing you with links to sign up for credit cards and home loans and such. The score they provide is only from one of the 3 bureaus (Experian I think?), so it’s not going to give you exactly what banks or other places might see, but it’s going to be in the same ballpark.

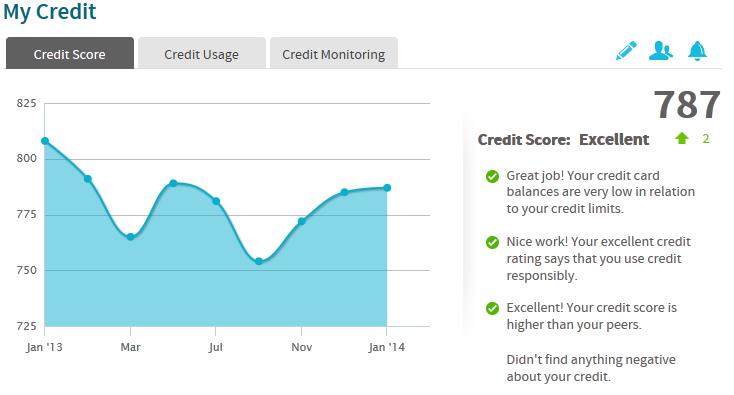

Here’s what my report looks like

I hope it’s not a major faux pas to post my credit score, but I wanted to give you guys an idea of the kind of report that they give out (for free). Now, it should be fairly clear which 2 months were the ones where I signed up for multiple credit cards 😀 , but you can also see that it has recovered both times. It is about 20 points lower than it was a year ago, but I think those can be explained by just random fluctuations. I also enjoy the first little checkmark they give me, which is a direct effect of my having so many credit cards 😀 .

Credit Sesame is a great tool to just keep an eye on where your credit score is, and to make sure you’re in the right shape for travel hacking. I’ve signed up both for myself and Carolyn. Disclosure: I do receive a commission if you sign up for Credit Sesame through my link. As always, your support is appreciated.

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

This is one of the topics that most interests/ concerns me. Thanks for addressing it!

Hello Dan,

I use a Capital one Sparks card with my business and spend anywhere from 20 to 60 thousand a month, but pay it off faithfully and have never paid interest on the card. My question is that friends of ours who are realtors say that paying of your credit card every month hurts your credit and does not improve your credit score. I just found you sight from the Sunday Morning show and love it.

Sincerely,

David Hille

Seattle

David – I’ve never heard of that. You should be able to check your credit for yourself and see your credit score for yourself –