Most of the time when I am approved for a new card these days, the credit limit issued is between $2,500 and $10,000. I have tapped out most of the credit that both Barclaycard and CitiBank are willing to issue me, often having to shift limit around to be approved for a product. I also make sure I lower my credit limit with Chase by at least $5,000 before applying for a new card.

My number of new card applications over the past two years has soared as well, and I have lately been getting denials (even besides those attributable to the dreaded 5/24). (SEE: I’m way over 5/24… I applied for a new Chase Ink card anyway)

Thus, I feel like I am close to capacity when it comes to the amount of credit that banks are willing to issue me.

Applying for the Avianca Vuela Visa

I didn’t know what to expect when applying for the Avianca Vuela Visa, which recently went live. If I could have bet on the outcome, I would have bet on a denial. So when my Avianca Vuela Visa application was instantly approved with a $25,000 credit limit, I was shocked.

Before the day I applied, I had never even heard of Banco Popular or Popular Credit Services. Apparently they are based in Puerto Rico. And they want to issue me a credit line of $25,000. Okay then.

Honestly, I don’t really care who a card issuer is, if they are willing to approve me for a product. The Avianca Vida and Avianca Vuela Visa cards issued by Banco Popular are both very good offers. If you sign up for either card, be sure to use promo code AVSPWE when you apply (application link here – not an affiliate link). The Vuela card in particular has an incredible sign-up bonus of 60,000 LifeMiles after your first purchase, as well as good earning rates. The perks include:

- Welcome Bonus of 40,000 LifeMiles after first card use (60,000 with the AVSPWE code)

- Earn 3 LifeMiles per $1 spent on Avianca purchases

- Earn 2 LifeMiles per $1 spent on gas stations & grocery stores (very nice!)

- Earn 1 LifeMile per $1 spent on all other purchases

- 15% discount on purchases of miles with Multiply Your Miles

- Free additional piece of baggage for travel between the United States and Central America

- A 50% discount on an award ticket redeemed for travel to Central America or Colombia from the United States after $12,000 spent each year

- An additional 50% discount on an award ticket redeemed for travel to Central America or Colombia from the United States after $24,000 spent each year

- Annual fee of $149, which is not waived

The Vida card is a lesser version with lower earning rates, an annual fee of $59, and an introductory offer of 20,000 LifeMiles (I have not confirmed that the bonus code increases that to 40,000). It may be worth the sign up bonus (if you don’t care about the app affecting 5/24), but it really isn’t worth keeping, in my opinion.

Why is the Avianca Vuela Visa such a good deal?

Prior to seeing the news on the coming new LifeMiles cards, I had never really researched the program. I heard the scuttlebutt from some that buying LifeMiles when on sale was a great way to fly first-class, but I never bothered figuring out why until I considered applying for the card.

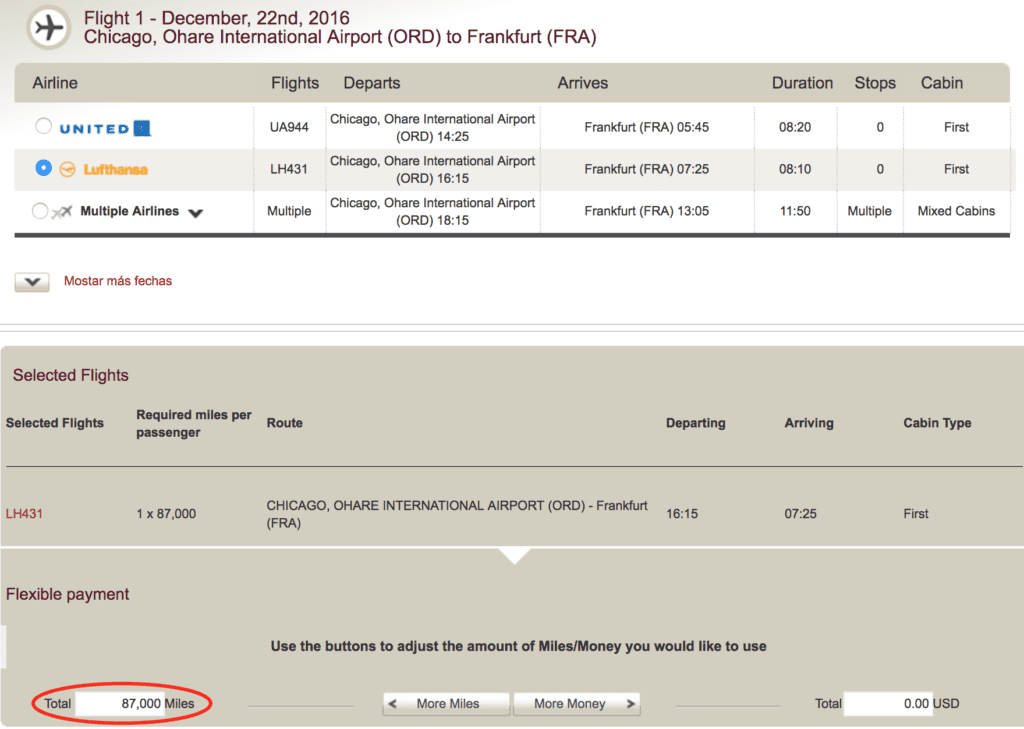

LifeMiles are actually an incredible currency to collect, and their award chart has some phenomenal sweet spots. (SEE: Crazy geography lets you book awards for only 7500 miles) One of the very best uses of LifeMiles in my opinion is Lufthansa first-class from the U.S. to Europe. An F ticket from San Francisco to Frankfurt costs only 87,000 LifeMiles one way. Contrast that with United’s 110,000 mile price tag. Air Canada Aeroplan may look like a good option at only 70,000 miles, until you factor in fuel surcharges. These can easily run over $500 on an award ticket. Not worth it, in my opinion, but it may be for some.

This is where LifeMiles shine. One of the biggest benefits to using LifeMiles is that, like using United MileagePlus miles, fuel surcharges are not imposed on award tickets! Ever.

So, with a single sign-up bonus from the Avianca Vuela Visa card and some grocery spending and/or MS (or transfer 20k Starpoints to 25k LifeMiles), you could easily have enough miles for a LF first-class award. That’s fantastic.

We’ll see if it is worth keeping the card in the long run. My wife and I will be headed to Central America at least once in 2017, so we may find our new LifeMiles card is worth keeping long term.

Header image curtesy of J. Babinsky, via creative commons 2.0 license.

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

I applied and was given the “we need to evaluate you” message and that I needed to upload my recent paystubs. I did and was moved to “APPROVED” pending i upload a confirmation of employment letter. My credit line is $50,000. I was kinda shocked. Never gotten a line that big.

Wow – that’s huge! Unfortunately, there’s not really a ton that a huge CL can really get you, unless you’re trying to really do some serious MS

I think the large credit line should help your overall credit score in the long term.

Agreed, it should. I am happy to have it for that reason, especially with a different bank than Chase, Citi, or Barclays. It is unlikely I will ever get close to utilizing it all. Unless I have reason to float some serious grocery store MS…

“Earn 3 LifeMiles per $1 spent on Avianca purchases” — this includes purchase of lifemiles?

It would depend on who the miles show as purchased from. I’m not sure with Avianca specifically but most mile purchases do NOT count as spend on that particular airline

per Lucky at OMAAT purchase of lifemiles is considered airfare spend. would be great if so with Avianca.

I would definitely defer to him as an expert in that area!

watch out for when looking for an international premium cabin award, and if it has connections, they can put you on a short-haul premium cabin & long-haul economy and still charges you the price for the premium cabin as if it’s premium all the way. The best use is for those non-stop direct flight between you origin & destination cities.

I just got declined, and don’t know why. I have 800-ish credit score, diverse credit bureau report, very good income, low utilization and so on. Have you heard about that? Thanks

I have heard that approvals / rejections have been all over the place with not a lot of rhyme nor reason

Stay away. I was denied,with no explanation and my credit score is over 750 with DTI of 10% and never had a problem getting financed or getting credit card. There is something fishy with this company, and now I waisted a hard pull thanks pos foreign bank/air line credit card.

Applied right after reading this post. Approved instantly for $20,400. CS in low 700’s. Love that rush !

Glad to hear it!! As you may see in the comments, YMMV when applying. Not sure what algorithm they use for approvals.

805-815 credit scores, earn 50/hr as a contractor, hours vary due to sabbatical/digital nomading. Have always put $100,000 on applications as that was my old salary when I was full-time and never had anyone deny me, or question anything (CSR, CSP, Barclay AA card, Citi AA card, AMEX Delta Gold/Plat, United Explorer all within last year) — I just got lulled to sleep. BAD MOVE. They requested my tax return, pay stubs, and a verification of employment from my employer. My hourly rate of 50/hr converts to 100K when annualized, but I am not working 2000 hours a year these days. I want the 60,000 LifeMiles bad, but I am not gonna go to the trouble to submit all this stuff, when my tax return doesn’t show 100K.

Live and learn I guess.

Do not fudge (even with non lying intentions) anything to these guys or it’s a waste of hard pull if you do not get the luck of the draw from their algorithm.