I always say that it’s a good idea to take advantage of as many opportunities you can for miles and points. That’s one reason I posted this roundup of currently active deals / giveaways a few days ago, and why I spent a few hours filling out envelopes in an attempt to get at least 100,000 IHG hotel points.

Although I don’t do a TON of manufactured spending, I’m familiar with the basics and try to diversify my points earning.

Citigold checking account

A few months ago, I wrote about a deal where you could get 50,000 American AAdvantage miles (or 50,000 ThankYou points!) for opening up a CitiGold checking account (and meeting a few minimum requirements). But the true beauty was that Citi lets you fund your new checking account with a credit card! You do need to be sure that the bank of your credit card won’t count it as a cash advance, but Bank of America is one such bank that typically codes things as a purchase. There was a bit of drama trying to fund my Citigold checking account, but eventually I was able to combine the credit lines on my multiple Bank of America Alaska Airlines cards and make a $39,000 “purchase”.

Then, once it cleared, all I had to do was do a bill pay from my new CitiGold checking account to pay off my credit card bill, and then it was just time to wait for the statement to close.

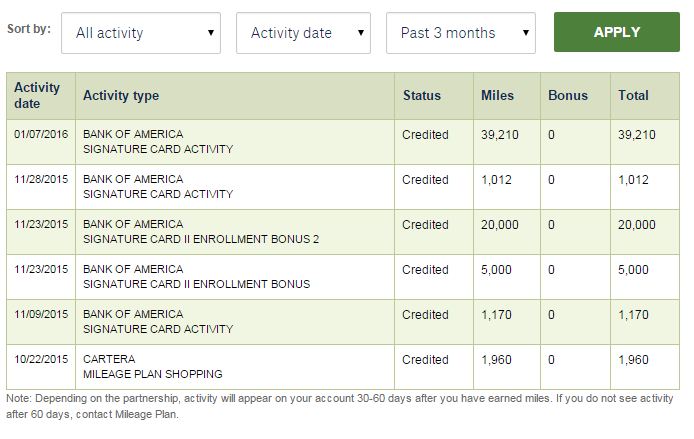

And then…. VOILA! Here we go! You can see the signup bonus I got, along with some miles earned from shopping portals (remember, diversify!) Time to plan that round the world trip with Alaska miles on Emirates First Class!

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

That’s great! Did your Citi gold checking bonus post yet?

No not yet – I still haven’t met the requirements. I’ve done the bill pay part but not the direct deposit part. They didn’t send me a debit card so I have had to call them (twice) to get that sent. Then my plan is to load it from Serve

Concluded my spend and requirements in November. No points yet in January.

I got the Citigold checking deal in mid September, met both requirements by end of October….still no points posted to my TY account. In December I chatted with a Citi agent who confirmed I met the requirements and said it would be up to 90 days from completion of requirements. That’s the end of this month. We’ll see…

Watch out, Citibank has the history to shut down customer checking account for unusual activity. Good luck

Can you confirm that the charges on your Alaska Air cerdit card did not incur a cash advance fee?

Yes – I can confirm they coded as a purchase. On the other side, when I tried to do it on my Chase Freedom, they DID count as a cash advance (which was declined)

Thanks.

Nicely done! I hop on the deal back when it only offered 30k miles, and only put 5k on my Barclays Arrival card. I was worried that it will be declined if I put more than 5k (even though my limit on the card was 10k).

Don’t forget to open a Savings Account that can also be charged to your credit card. I did and life is good!

That’s a pretty good idea!

We’re you able to have B of A set your cash advance limit to zero?

I forget if they set it to $0 or just some other small number. Regardless, by default they said it was 25% of the credit limit so the $39,000 purchase would have been declined anyways if it had been coded as a cash advance. Like I said, it was coded as a purchase by Bank of America

So you funded the checking account with the Alaska Visa and then paid off the Visa with the same checking account? That sounds sketchy. Good luck.

Unless you got Bill Gates to cosign, how did you get a $39,000 credit line on one card?

@jerry

Its not that difficult. With a steady job, good credit score etc they tend to go up over time. My highest is a citi executive with a 61k limit. Not that I need it that high.

As the other commenter points out, it’s not that hard. In my case I had 3 Alaska Airlines cards, and just called to combine their limits

My account has been open now for 6 months. If I close it, how long do you think I have to wait to open another one and get a sign up bonus (assuming one is still offered) and, of course, fund with credit card?