I recently had a negative experience signing up for a Chime bank account and wanted to share my experience of what I think was a fairly dirty trick by Chime that cost me a 5/24 spot. At the very least, I’m hoping that it will serve as a cautionary tale for you about Chime (and other banks)

Signing Up For Bank Bonuses

Like many of you I’d imagine, I also regularly sign up for bank bonuses. Just like with credit card welcome offers, banks also are trying to entice new customers with welcome bonuses for signing up for a new account and completing a variety of different welcome activities. It might be direct deposits, a certain number of transactions, or depositing a specific amount of money. Depending on how aggressive you are (or how many adults are in your household), this can be worth hundreds if not thousands of dollars a year.

Signing Up For A Chime Bank Bonus

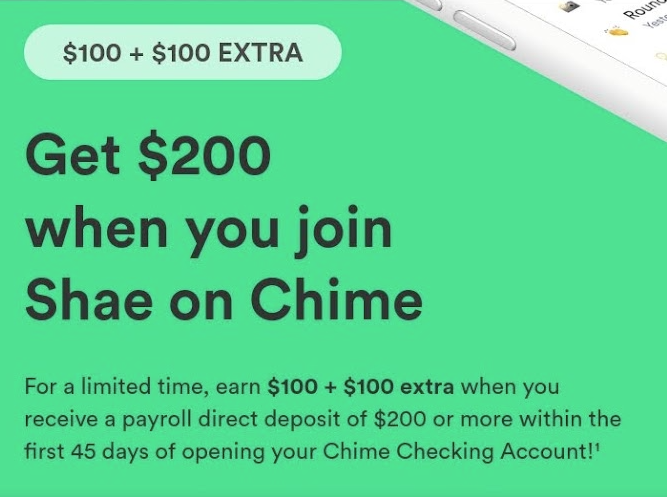

A few weeks ago, I signed up for a bank bonus with Chime Bank. At the time, it was offering up to $200 as a bonus for a direct deposit of $200 and no deposit requirement. Of course, just when I was about to refer the other adults in my household and also post about it, the deal died (it’s now only a $100 bonus).

I will admit to not reading the fine print closely, but apparently one of the checkboxes that was checked by default was to ALSO sign up for the “Chime Credit Builder” credit card (in addition to the bank account).

Getting A … CREDIT Card In The Mail?!?

I didn’t notice anything about this while I was opening the bank account, but then started getting emails not only related to my new bank account, but also welcoming to my “Chime Credit Builder Credit Card” account. Sure enough, a few days later I got both a debit card and a new credit card. In reading some of the comments on the relevant Doctor of Credit post, I saw a few other people that were bit by this.

I signed up to open a Chime account, and then a few days later I received an email saying my visa credit card is on its way. How did this happen? I even read another commenter say this almost happened to them, so I was careful which boxes I selected. Has this happen to anyone else? I don’t feel like that should be illegal to deceive people into signing up for a Credit card. I’m pretty pissed as this will put me at 5/24.

Sure enough, I had a hard pull on my credit report and added 1 to my Chase 5/24 number. In my situation, I have started taking things a bit slower (and focusing on business cards), so I am not quite as close to 5/24, but it is still super annoying.

Trying To Fix The Problem

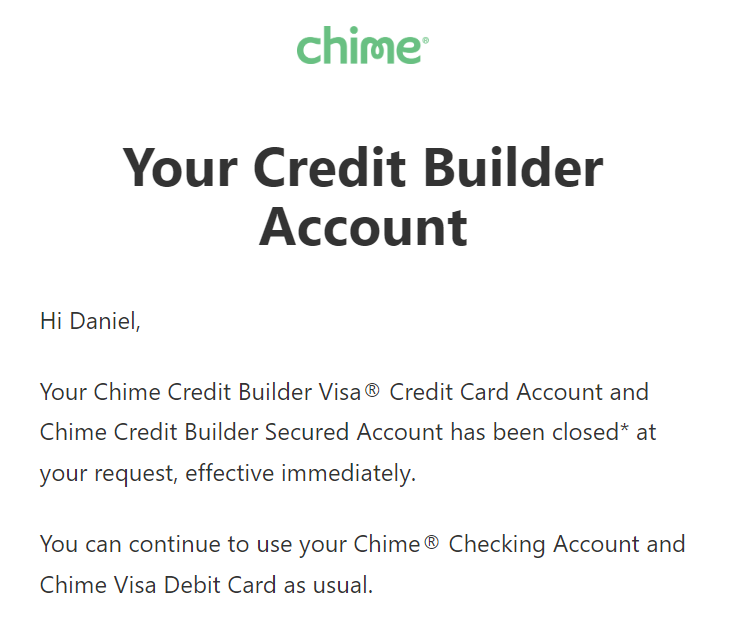

I figured that there was not really anything that could be done at this point, but I tried a few times talking with the Chime customer service people to see if somehow the credit card account could be “canceled” or if that would do anything. The customer service agents I got were…. not helpful. They kept saying they could cancel the credit card account and it would not affect my credit at all, not really understanding that the hard pull had already been done and they couldn’t undo it. I did end up closing my Credit Builder account.

The Bottom Line

I signed up for a $200 bank bonus with Chime bank, but inadvertently signed up for the Chime “Credit Builder” credit card as part of the application process. It’s on me for not reading the fine print carefully enough, but it was still an annoying trick (and dark UX pattern) that they snuck in that check box and signed me up for a credit card that I didn’t want to have.

Ever had something like this happen to you? Leave your experience in the comments below

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Recent Comments