Any frequent flyer is well aware that airfare purchases come with a wide assortment of taxes and fees. One of the most controversial and confusing taxes in the aviation industry is the Air Passenger Duty or “APD.” Air Passenger Duty is a tax or “excise duty” that is charged for flights LEAVING from an Isle of Man or UK airport. APD is not charged on flights coming into the United Kingdom. Outbound flights from Northern Ireland or the Scottish Highlands and Islands regions are also exempt.

To make it even more confusing, the Air Passenger Duty has rate bands based on distance traveled, fare type purchased, layover timeline exemptions and age minimums. Are you confused yet? Let’s break it down for you!

What Are Air Passenger Duty Distance Bands?

Each passenger is charged APD based on their final destination and the distance of that country’s capital city from London. Before April 2023, there were two APD bands, but now there are four APD bands. The APD rate bands are broken down into four destination bands as follows.

- Domestic band for destinations in England, Scotland, Wales and Northern Ireland only

- Band A are flights where the distance from London to the destination country’s capital city is between 0 to 2,000 miles

- Band B are flights where the distance from London to the destination country’s capital city is between 2,001 and 5,500 miles

- Band C are flights where the distance from London to the destination country’s capital city is over 5,500 miles

A review of the UK Government website provides a concise list of Band A destinations. The Air Passenger Duty for these short haul flights is lower compared to those beyond the 2,000-mile threshold. A journey to a Band B or Band C city is considered a long haul flight and has a significantly higher APD. Of course, the Air Passenger Duty also varies based on your class of service, and this is known as your “Rate Type.”

What Are the Air Passenger Duty Rate Types?

Besides the distance you travel, APD rates will also vary based on the class of travel. These are broken down into three rates of duty.

- First, the reduced rate is for travel in the lowest class of travel available on the plane. This is measured by seat pitches less than 1.016 meters (40 inches). For most flights, this means basic economy or perhaps main cabin.

- The standard rate is for travel in any other class of travel where the seat pitch is more than 1.016 meters (40 inches). This will normally include premium economy, business, or first-class seats.

- The higher rate will typically only affect private planes as it is charged for travel in planes of 20 tons or more equipped to carry fewer than 19 passengers.

The above Air Passenger Duty rate types should be fairly straightforward for most passengers. Private jets or business jets may have to calculate their APD and should check out the UK Government website for details. The wild card for most passengers would be upgrades.

How Do Upgrades Affect the Air Passenger Duty?

What happens if you buy a seat in Main Cabin and then decide to upgrade later? According to the Air Passenger Duty guidelines, “If a passenger pays to upgrade at any stage in the journey, then they’re travelling in the higher class.” This means you could be looking at paying the higher standard rate. For a long haul flights, that would more than double the APD tax.

It’s not just paid upgrades that could get hit with an increased APD rate. The government website goes on to state that “The same applies to free upgrades if there’s an element of entitlement or priority not enjoyed by other standard class passengers.” However, passengers remain in “standard class if they get a free upgrade but have no expectation of, or entitlement to one.” This means a passenger who has airline status and gets upgraded from economy class may be stuck paying the increased APD rate. Make sure to ask about an increase to the APD charge if you accept an upgrade and paying the increase would be an issue.

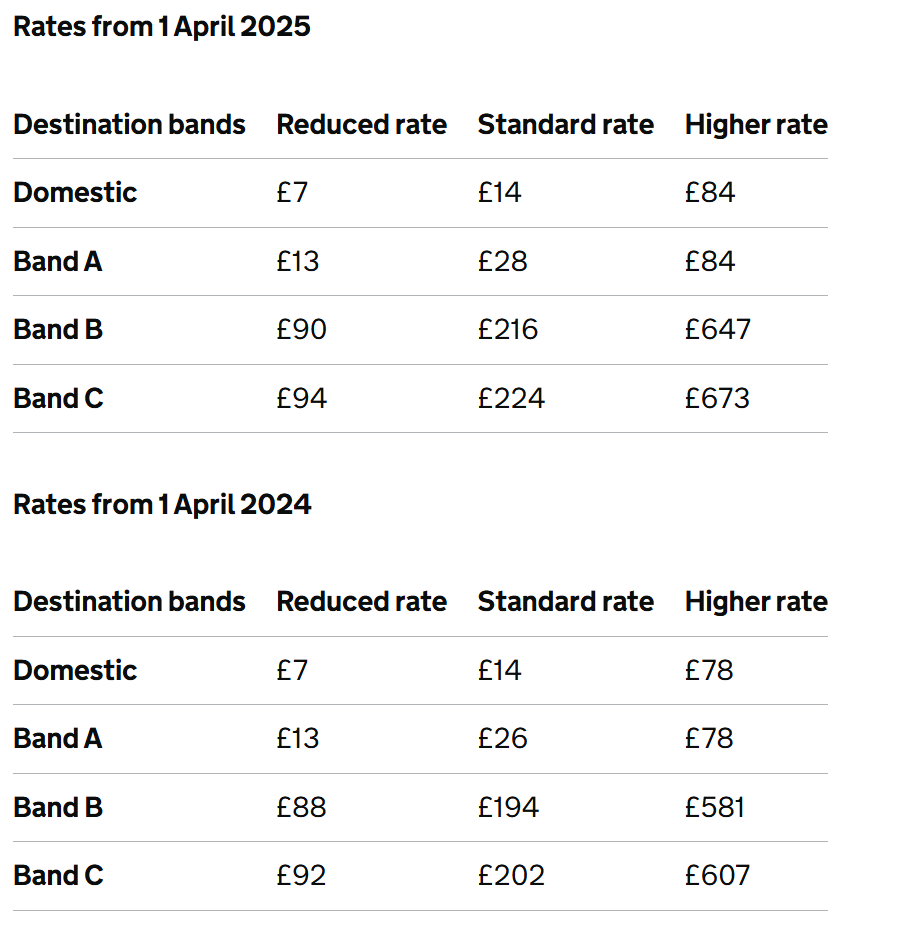

What Are the Actual Air Passenger Duty Rates for 2024 and 2025?

The rates have changed multiple times since being introduced in November 1994. The current rates, which are good for flights departing through March 31, 2025, are shown below along with the new rates that will take effect starting in April 2025.

Depending on your airline, destination, class of service and number of people in your party, a big chunk of change may be spent on the Air Passenger Duty. This of course has flyers looking for answers to the question of how to avoid paying APD.

How Can I Avoid Paying Air Passenger Duty?

Given the added cost of APD, most travelers want to know what can be done to keep from paying this fee. There are some ways to avoid UK APD while flying, but most will not apply to the average passenger. We have previously talked about a few ways to not pay UK APD in the past and you can see an updated list below.

- Children under 2 traveling as lap infants are exempt regardless of cabin.

- Children under 16 can avoid the tax if they are traveling in economy (other classes may work as long as seat pitch is under 40 inches).

- Depart from Northern Ireland or the Scottish Highlands and Islands.

- Connections in the UK for less than 24 hours.

- Pilots and cabin crew members on duty.

- Book an open-jaw flight. With this strategy, you would fly into the UK and then take another form of transport out of the UK to catch a departing flight. This will certainly take more time and may potentially cost even more money. This option works best if you plan to visit another city anyway.

How Can I Reduce Air Passenger Duty?

If it’s not possible to completely avoid paying air passenger duty, you may still be able to reduce the fee that you pay. The options below may be better suited for those with more time than money. However, they are possibilities to consider if you want to pay a lower APD tax.

- Remember that fees are only charged when leaving the UK. You could take a short flight to another European airport before departing on a separate ticket for your long haul flight.

- You could fly into the UK in a higher class (i.e. business or first) and depart in economy to pay the lower “reduced rate.”

Outside of the options above, most passengers who fly into the UK will end up paying the Air Passenger Duty.

Will the UK Ever Ditch Air Passenger Duty?

Air Passenger Duty has had multiple increases since its start in 1994. Last year the UK government raked in almost 4 billion pounds from the tax. Once government sees revenue inflows from a tax or fee, it can be difficult to reverse the spigot. With that being said, in 2020 the travel industry was hit hard by COVID-19. Worldwide airlines were hit by an increase in costs and a decrease in passengers.

British airline Flybe was one airline that ran into financial trouble during this time. Flybe argued that the APD was a drag on their business. One of the proposals to rescue Flybe included allowing a deferral of the APD tax bill for several years. This became a hot button issue in the UK. There were multiple arguments and viewpoints for and against the deferral. In the end it did not matter as Flybe eventually filed for bankruptcy. The future will probably see proposals to defer or eliminate APD for specific airlines or the industry in times of crisis. However, the complete repeal of this tax is probably never going to be in the cards.

Conclusion

The UK is now closing in on almost 30 years of charging Air Passenger Duty and it seems as if the pesky tax will continue. Even with the tax, the UK is home to some of the busiest airports in the world. The sheer number of destinations available from UK airports will continue to attract travelers … and the revenue the UK government gets will probably keep Air Passenger Duty in place.

What are your thoughts on the Air Passenger Duty? Does it affect how you plan trips to the UK or other destinations? Do you have a strategy to avoid or minimize the fee? Let us know in the comments below!

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Nice write up. These hefty taxes certainly deter me. Add in BA’s famously bloated YQ on award tickets and you have some pretty compelling reasons to avoid the UK.

Have not flown into the UK for over a decade because of these onerous and unjustified taxes.

The overall loss to the UK is significant since we used to spend weeks travelling around the country.

I will NOT PAY these duties under any circumstances. Interesting that Aer Lingus is now flying to North America and that departures from Northern Ireland are free of this tax. Thanks for the heads up.

Thanks for the info, these taxes drive me crazy. I’ve changed my pattern of flying as a result. For long-haul flights I will often take a short hop to AMS, FRA or CDG on another airline, and then do the long-haul flight from that city.

These duties are absolutely outrageous, and savvy travelers around the world are well aware that the UK has the highest duties. Unfortunately for now, the government doesn’t seem to care that many travelers are avoiding the UK for this reason.

I will not fly home to ORD from LHR. I will always go to DUB first then fly home. These are ridiculous fees.