My wife and I have been applying for credit cards for over 5 years, in order to get the benefits and rewards associated with cards. Over that time, the situation has changed quite a bit, but there still is a lot of value in getting new cards. 5 years ago, it was common to sign up for multiple cards all in one day. The belief back then (real or imagined) was that if you applied for multiple cards on the same day that they would combine into only one hard pull on your credit. It was also common back in the day to be able to sign up for and hold multiples of the same credit cards, and get the bonus over and over again.

Those times have for the most part changed, with the advent of Chase 5/24 and other similar rules put in place by many of the banks and other credit card issuers. However there is still quite a bit of value in applying for new credit cards.

(SEE ALSO: Overturning Chase 5/24 – here’s how I did it)

(SEE ALSO: Why I’ve stopped being concerned about 5/24 (again))

Applying for new cards

My wife and I look to apply for new cards every couple of months, depending on the offers that are out there and other things that are going on. We actually both got under Chase 5/24 earlier this year, and have been regularly applying for new cards since then. Our first cards were getting some of the Chase business cards.

(SEE ALSO: The 2 types of cards not subject to Chase 5/24)

(SEE ALSO: What should I do with my Chase Inks?)

These cards are nice because you have to be UNDER 5/24 in order to be approved for them, but they don’t count as additional cards TOWARDS your 5 card limit. So as we got into June 2020, we started looking for new cards to apply for. Here are some of the cards we considered:

- Barclays AAdvantage Aviator Business card

- Hilton Aspire Card

- Chase Ink cash

- Chase World of Hyatt card

What cards did I decide to apply for?

After thinking it over, I decided to apply for the World of Hyatt card for myself (my wife already has it) and the Aviator Business card for my wife. We are fortunate in that we have several businesses that we can use to apply for these small business cards.

(SEE ALSO: Business credit cards even if you don’t (really) have a business)

I also am planning on upgrading my wife’s Amex EveryDay card. She is in the middle of participating in one offer on the EveryDay card – an offer that gives 2500 Membership Rewards after spending $500 on an authorized user card. We signed up 4 of our kids as authorized users and are going through the spending requirements. Once that is done, we plan to upgrade her card to an EveryDay Preferred card. Amex is offering the ability to upgrade to the EveryDay Preferred and get 25,000 Membership Rewards. This is great because it doesn’t even count as a hard pull

Also, since our older kids have turned 18, we’ve also helped them apply for some of the more introductory and cash back related cards, like the American Express Cash Magnet card and the Bank of America Cash Rewards card.

Results

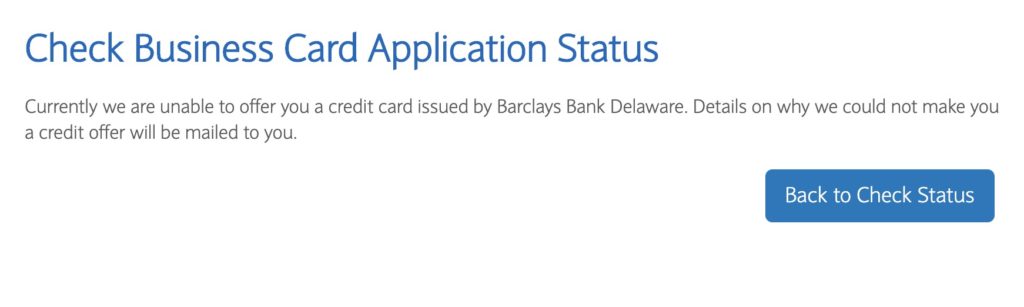

When I applied for both cards, I was not instantly approved on either card. A few days later, I got a notification that I was approved for the World of Hyatt card. Checking into the Barclays business card application status page for my wife’s card, I found that she was unfortunately not approved.

We will plan on reviewing the information that Barclays sends us by mail and see if we can get approved with a phone call. I know that Barclays is notoriously stingy with their approvals, so we’ll see what the reasoning is. That will impact the odds of whether we’ll be able to be approved during reconsideration. I’m sure my wife will be SO excited about calling a credit card company 🙂

What’s next?

If she’s not able to be approved for the Aviator business card, we’ll look at applying for something else instead. The Hilton Aspire was the other card that I had considered for her. I canceled my Aspire back in January 2020 and as we look to travel again, it might be a good idea to get more Hilton points and Diamond status. The Ink Cash would be the other option I’d consider.

What cards have you been applying for lately?

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

I take this as a two-step process: first, review cards to trim, then what to add. We have dozens of cards, but we trimmed three. I picked up two I needed: Chase Freedom Unlimited (Unbonused VISA spend, mostly for Costco after first $15K each year on Hyatt Visa) and AMEX Bonvoy Business. The latter I added because Bonvoy now gives 15 elite nights each for personal and business cards, so I start each year with 30 elite nights and two free night credits. My wife picked up the AAdvantage MileUp to prevent her 160K AA miles from expiring.

My wife and I also managed to get under 5/24 for the first time in years. Working on the Ink porfolio. Most recently applied for the Barclays business card and CitiBusiness card. I’m within striking distance of AA million miler threshold but wanted to use cards that provided 2x points in as many categories as possible to also bulk up the miles. Recently upgraded Hilton card from surpass to aspire for 150k points. Had previously upgraded same card from basic Hilton to Aspire for a like number of points. Got the United business card with 100k and 10K spend offer.