2019 was a great year for cheap flights worldwide. Coach deals to the other side of the world were constant, and if you were really lucky you could fly first class from Asia to the US for about $1100 round trip. While there’s no guarantee we’ll see those deals again, I feel confident making 3 low fare predictions for 2020. But knowing the travel expertise of PWaC readers, I want to read what you expect too.

Predictions for 2020 #1: Sub-$400 Deals To Europe Will Continue To Flourish

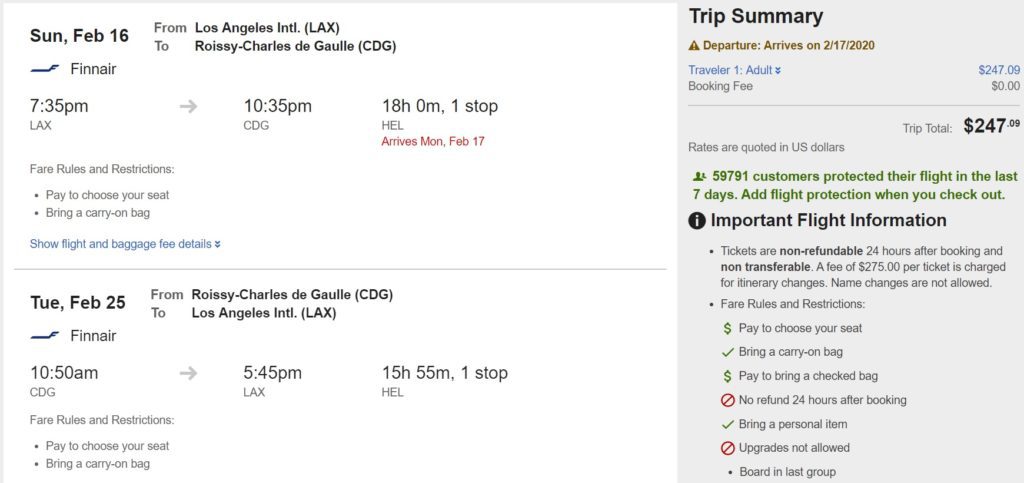

Finding ~$300 flights from across North America to Europe has recently been a matter of patience and not luck. And $400 flights are now available from many large airports on a regular basis. Granted those are usually (but not always basic economy). You can buy-up to main cabin for about $120 round trip, so it’s still a deal.

There’s no reason to expect these fares to spike in price, necessarily. Fuel costs may start driving prices somewhat higher, but competition will keep prices in check. Major airlines have added capacity too. You’ll still find flights from across the USA to Europe for less than $400, and yes, even sometimes during peak summer season.

Prediction #2: Premium Economy Deals Will Spread To More Flights

Premium economy bookable as a separate cabin really exploded last year. That doesn’t mean it was always a good deal, though; often it was over-priced. PE fares on the longest flights were sometimes as much as $1000 more than main cabin prices. But with a little searching, you could score great deals on bigger seats and better service for as little as $250 over coach.

As premium economy becomes more available, deals should start appearing more often. United has just expanded domestic PE options, and added international routes. I expect to bring you more opportunities like this from across the USA to Spain. Asia PE deal destinations will become more widespread than just Singapore and China. Sometimes, it’s worth it for a more comfortable 13 hours in the sky.

Prediction #3: Alaska Air Will (Finally) Devalue Their Award Chart

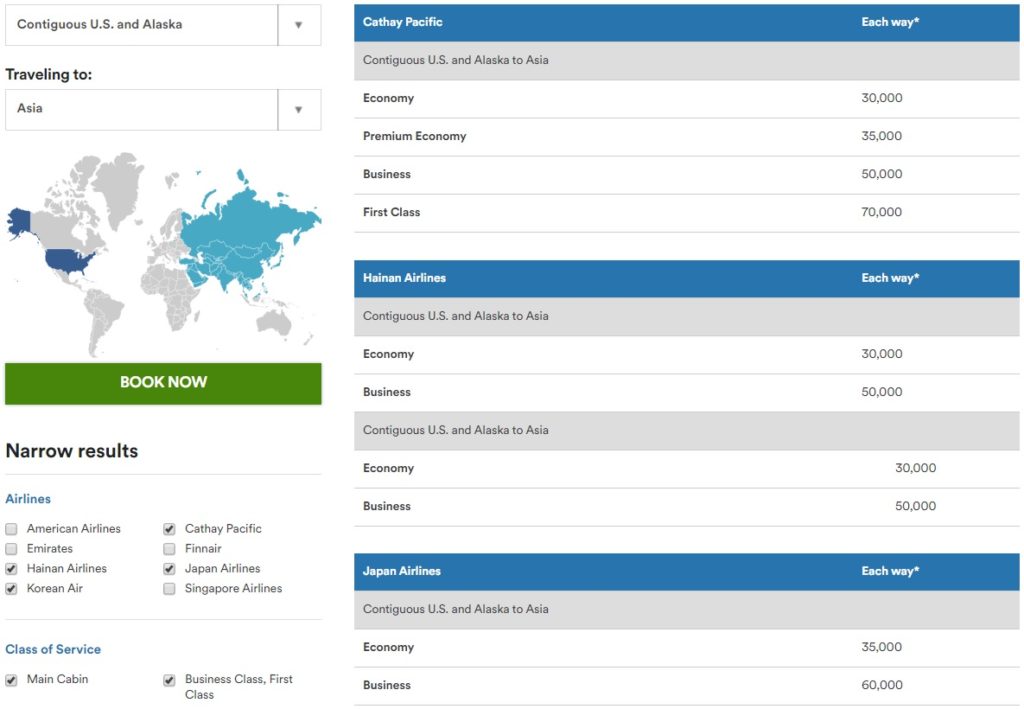

I hate to give a negative prediction, especially one so, well, “predictable.” (I know this isn’t technically an “airfare” prediction, either.) Travel writers have been expecting the death of Alaska Air’s fantastic awards, especially premium cabin awards, for years. After all, airlines have eliminated less-valuable awards, far more quickly? Why would Alaska keep the cheapest business class awards to Asia if they didn’t have to?

Alaska is committed to maintaining “the industry’s most generous mileage plan.” But they’ve never guaranteed they won’t change award costs. With American, Delta, and United now using dynamic pricing for awards, Alaska has less pressure to keep an overly customer-friendly award chart. I’m afraid that 2020 is the year deals like 50,000 mile business class flights to Asia will disappear.

Predictions for 2020 Conclusion

Making airfare predictions for 2020 isn’t a huge risk, but it’s definitely fun. I’m not psychic, and I’m sure you all have good ideas about what we’ll see this year. So what are your airfare predictions for 2020?

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Another prediction. I expect a merger by Alaska. Could it be they purchase someone or something? No.

My bet is that Alaska is acquired and to satisfy the regulators, divestitures of a limited number of routes in the SFO and possibly LAX and SAN areas – not really much in the way of divestitures in the PDX, SEA and Alaska markets.

The buyer? That little airline that calls DAL Love Field their home.

WN could desperately use the capacity and play around with the Airbus equipment for few years before they go off lease.

Would WN operate AS as a separate brand along with QX? For a short time until certificates and union seniority lists are merged, and possibly an agreement with OO to keep some of the commuter routes in place for a short time, with QX being shut down very soon after acquisition.

After about 3 years from acquisition, everything will be under the WN brand, including on board service and their now famous two bags fly free offer.

SEA, PDX and to a lesser extent, the state of Alaska keeps most service. The big push back will be by the pols from Alaska who will fight any attempts at diminished service by WN in Alaska, and WN will have to offer a set of guarantees keeping most Alaska service (or finding someone else to operate the inter and intra Alaska routes) that WN chose to eliminate.

The cost savings would be huge – AS’s large fleet of robust of fairly new 737’s that can be easily integrated into WN’s system. Who knows, WN might even keep the 739’s and the 737-9 MAX’s.

WN then can finally solve the gate problem at DAL by taking over the single AS gate (unless the regulators require WN sub lease/sell to another airline…Delta…is that you calling on the other end of the line?).

If WN acquires AS, this will give WN the ability to raise fares across the board in most markets and develop it’s offer to corporations – as WN finally (after how many decades?) begins to fully participate in the CRS systems that corporations use to book and ticket travel.

Even if WN does not acquire AS (or another airline) WN’s fares will increase across the board by the simple fact that the ability by corporations to easily book and ticket travel on WN becomes commonplace at those companies that deploy either Amadeus and/or Travelport (Apollo/Galileo), and WN can thereby increase margin for business-type fares and reduce reliance on lower yield non-refundable type fares.

Why? Corporations who book travel will now have WN’s instant availability on their screens via the CRS instead of having to go to the the clunky WN website to build/change an itinerary.

Other predictions – Frontier, Allegiant and/or Spirit will merge with someone, not necessarily among themselves. It’s an economical way by the big boys to get rid of pesky LCC’s hanging around…get’em while the LCC’s share price is low.

SO_CAL_RETAIL_SLUT