The Citi Dividend brings an interesting twist to the regular 5% cashback card. Instead of a $1,500 spend limit ($75 cashback) quarterly, like the Discover it or Chase Freedom, you have a $6,000 limit annually. Citi doesn’t mind if you spread it out, or earn your Citi Dividend first quarter cashback all at once.

That makes the first quarter great for Citi Dividend holders!

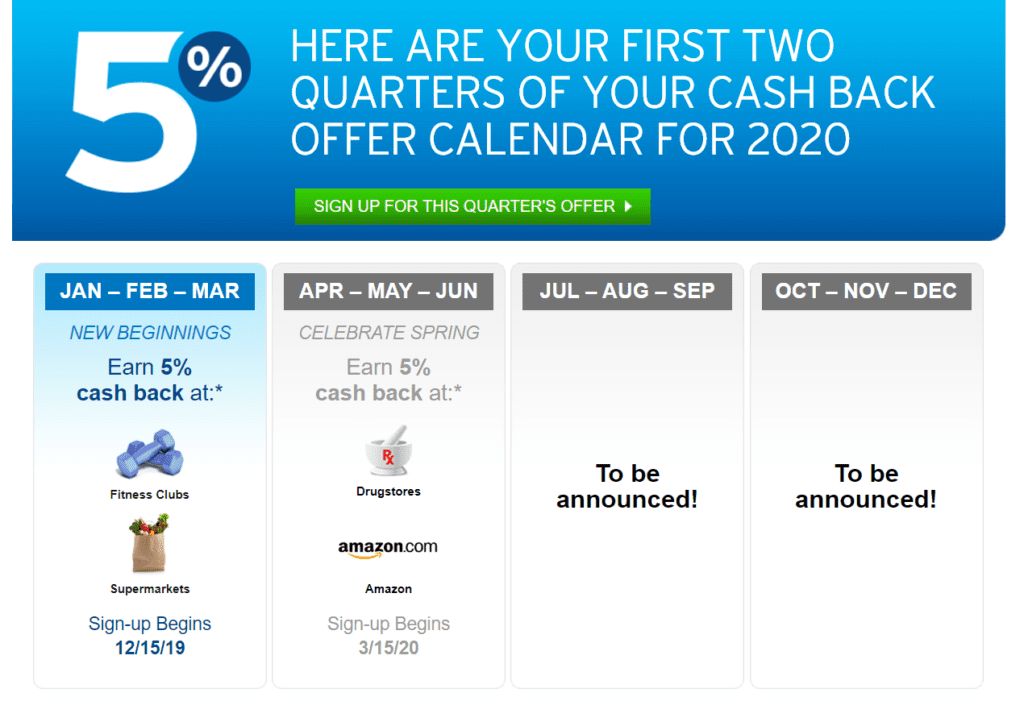

For January through March, swipe your Dividend at grocery stores and fitness clubs to earn 5% back. Fitness clubs is a new one to me. Though I imagine some cards have the bonus category, it’s not a common one.

I love the “theme” for the first quarter – new beginnings! Ahh yes, no more turkey dinners or holiday cookies. Time to hit the gym and eat healthy again!

Tips for Maximizing the Citi Dividend First Quarter Cashback

- Buy gift cards. Most grocery stores have large gift card racks. Pick up the ones you’ll use and get your 5% cashback ahead of time. (Make sure you don’t lose the gift cards!)

- Similarly, if you’ve got birthdays coming up, pick up any gift cards you need at these stores, rather than the merchants themselves.

- If you can float the cash, prepay your gym membership for the year! (Then you have to go…)

- Or better yet, buy a membership or a gym gift card for a friend that will appreciate it. Maybe a birthday gift for your gym buddy!

FULL OFFER TERMS

Fitness clubs are classified as merchants that operate sports and recreation facilities requiring membership. Supermarkets are large retail markets that sell foods and household merchandise. Purchases made at Target, Walmart, Kmart, Meijer*, general merchandise/discount superstores, freezer/meat locker provisioners, dairy product stores, miscellaneous food/convenience stores, markets, drugstores, warehouse clubs, wholesale clubs, specialty vendors, bakeries, candy stores, nut stores, confectionery stores, or meal kit delivery services do not qualify. Purchases made at online supermarkets also do not qualify if the merchant does not classify itself as a supermarket by using the supermarket merchant category code explained below. *The above names are trademarks or registered trademarks of their respective owners. The owners of the above marks do not endorse Citibank, N.A.’s products or services, and are not otherwise affiliated with Citibank, N.A. or its affiliated or parent entities.

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

So you can only earn 5% off $6000 total for the year. So if you use the card the first quarter and spend $6000 you don’t earn anymore 5% for the remaining of the year. Am I reading this correct?

Hey Debbie! (Full disclosure, I don’t have a Dividend card) but yes, I’m pretty sure we’re on the same page. $6,000 of 5% back earning, no matter when or where you spend it.