We’ve talked about the upcoming changes to the Starwood cards from American Express.

We’ve talked about Chase revamping its portfolio of Marriott cards.

So…what if you have one of the cards? I don’t think I’ll have that problem soon…

Summarizing the Changes

Really, the changes aren’t massive. The biggest change in the cards seems to be the new designs.

Let’s boil it down here:

- All Starwood and Marriott cards are getting new names under the Bonvoy loyalty brand.

- The Starwood Business card is becoming the Marriott Bonvoy Business American Express, the annual fee will increase from $99 to $125, and you’ll have the chance to earn an additional free night (up to 35,000 points) after $60,000 in annual spend.

- The SPG Luxury Card is turning into the Marriott Bonvoy Brilliant American Express Card and will get a $100 annual property credit, to be used at St. Regis or Ritz-Carlton for stays of at least 2 nights.

- The Marriott Rewards Premier Plus Business Credit Card will be the Marriott Bonvoy Premier Plus Business Credit Card from Chase and will also have the ability to earn a free night (up to 35,000 points) after $60,000 in annual spend. (But this card will be closed to new applicants on February 12th, 2019.

- Chase will be releasing a new, personal, no fee Marriott card this summer.

The interesting change to me, is the increased annual fee on the Starwood Business Card. I currently hold the business card, and have for quite some time. It was the first business card I opened for my side hustle! While I have another AmEx Business card I use frequently, I might have to trim the edges.

Why I’m Closing my Starwood Preferred Guest Business Credit Card from American Express

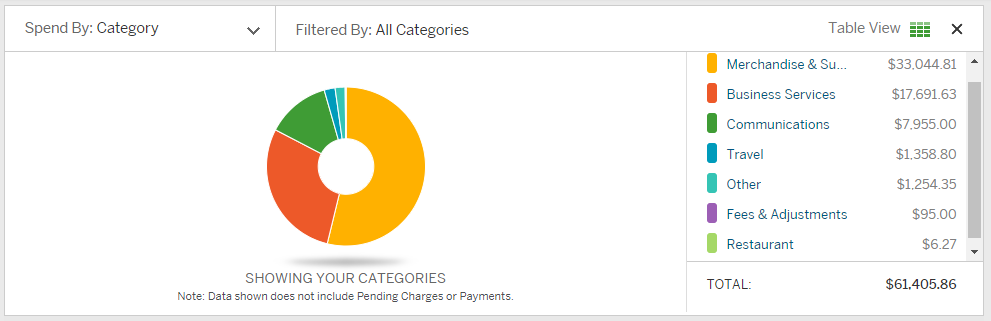

Here’s the thing: The annual fee is increasing, without any tangible increase in benefits. I barely spent $60,000 last year on business purchases, and I’d be surprised if I hit that level of spend again this year on the Starwood Business AmEx. Remember, I’d have to hit $60,000 in spend to get that second free night.

You have to know the reason I spent so much on that card last year too – I wanted those SPG points! If you remember, the Starwood cards used to all earn 1 Starpoint per dollar spent on everything (double points on Starwood hotels). When Marriott and Starwood merged, Starwood points were transferred into Marriott points at a rate of 1:3. That means the Starwood business card I had effectively earned triple Marriott Rewards on everything (or at least for most of the year). Now, it’s only earning double Marriott Rewards! That, in itself, is a huge devaluation. Since very little of my business spend is in bonus categories, the triple Marriott points was fantastic for me.

There’s no way I’m keeping this card now, with a higher annual fee and a lower earning rate. On my to do list this week? Call American Express and close out my Starwood Business card. At least some of our readers agree with me..

How about you?

(This post is Starwood Business AmEx-centric; I closed my personal SPG sometime last year. As a reader pointed out below, there is an interesting retention offer on the personal card – If you had your personal card open prior to January 23rd, you’ll be eligible to earn up to 100,000 bonus Bonvoy points. You’ll have to register, and points will be awarded in increments of 25,000 for $25,000 spent within the calendar year. If you’re a bog spender, this might convince you to keep the personal card open. You’ll effectively be earning triple Marriot points, akin to the value of the card under the Starwood program.)

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

I will definitely be downgrading my SPG Lux after anniversary, after I use credit and get FN. I might then hold on to the downgraded card for a while for FN and elite night credits, but I might ditch Marriott altogether. No point in any other Marriott card, especially the biz card.

You’re not alone! I’ve heard a few people with a similar strategy, looking to rack up some elite credit

Huh? If you spend that much with the new card you do get 3x

Hi James, the business card will earn double points on all purchases, but the personal card has potential for triple points if you had the card open prior to January 23rd I did add in some info at the end of the post about the personal card!

Why did you put an exclamation point after “side hustle”?

Uh oh, the exclamation point police are out again!! 🙂 I was excited about it, that’s all..

crazy to increase the fee to $125 w/o giving anything.

I had 2 SPG bus cards, i think both will be out of the door.

For those that are looking to get access to programs like Miles & More, Asiana, Alaska, etc. I’m not seeing a better option than an SPG card moving forward, unless you literally want to get the CC for each program, which most of us would agree is excessive. That flexibility is pretty valuable still I think, especially as there is an annual free night on the card now for the $95 AF.

Good point Sean, but the Marriott cards should open up this door too right? Do you just mean any SPG/Marriott cards, or SPG specifically?

Yes. I think it still makes sense to put some spend through it if you can consistently do 5-digits annually, maybe in conjunction with a Freedom Unlimited or Amex EDP. When they do offer the $25K(?) incremental bonuses, then it becomes a no-brainer.

I’m definitely canceling my business SPG card. With the reduction in earning power (both via spend and via referrals), I don’t see any benefit in keeping it.

The only question is whether I should bother to wait until the annual fee posts to cancel or just cancel it now.

I’m cancelling my business card but keeping the Luxury Card.

My personal SPG card I will keep since they are supposedly going to be offering a retention bonus that will restore the old SPG earn rate in increments of $25k in spend up to $100k in 2019. The business card is gone with the new fee as I have zero interest in keeping it at the higher AF. If they offer a similar deal as the personal card on spend then I *might* keep it but even then unlikely. Marriott sticking to its old habits of constant category inflation on hotels is not helping the value of the free night certs at all in my opinion.

Good point! I saw that on Reddit here, I added in some clarification to the post. I was only thinking of the business card, as I’ve never had the Luxury, and closed my personal SPG sometime last year.

I’m ditching my biz card as well for similar reasons. It’s just not worth it, and I’m tired of the death by a thousand cuts approach Marriott seems to take.

Ryan, totally agree – I’m going to miss the Starwood program 🙁

Does the new spg business card still give a free night up to 35k on your anniversary? If so, isn’t that worth the new $125 fee?

MARRIOTT/SPG are so screwed up that you shouldn’t bother with the free night. Booked a free night at Westin Melbourne and Marriott double charged an extra 35,000 points instead and deleted the free night. They are ignoring my emails and tweets.

Can’t see any reason to keep it. Free 35k night just rubs salt in the wound. 35K? Where?

Just used a 35k free night at the Westin Punta Cana in the Dominican Republic, which is fabulous enough to warrant a much higher “price” (in points). Our room would have been $300+ had we paid for it, so that’s more than twice the annual fee right there. There ARE still some bargains out there that make the free nights worthwhile.

I recently supposedly ‘used’ a 35000 point award at both the Westin and Marriott in Melbourne during the Australian Open when the rack rate was north of $650. Unfortunately Marriott cancelled the free night and stole 35000 points from my account instead.

So if you can get Marriott to actually process the annual free night properly then there can be value to be had. That’s a HUGE IF at this point!

The reason i Disagree and will keep the business card. Now i admit i have not read through all the responses and info yet. I will do so when i get back to the hotel.

The spend in the business card does NOT inpact your credit score. They only report if you default. I was spending significantly on persknal cards and paying many off quickly. It sis. If matter whatever your balance is at closing is reported. Business cards di not report. I learned this which many of you may know as i watched my credit score drop to the mid 600’s. Now i use business cards and pay after the close or even carry a balnce. I try to pay the personals i use heavily before the month closes and my score is back in the high 700’s again. Think about that before you cancel a business card. I did it once and it was a problem with my score

Good point Leonard! I’ve got other business cards, so I’ll be using those frequently.

A good opportunity for retention offers?

Definitely! I think it makes sense that AmEx would be willing to give out decent retention offers on these, with all the flak the new cards are getting online, they’ll be worried about losing too many customers.

When do new fees begin? Mine are about to renew and I was considering keeping all three SPG, SPG Biz and Marriott biz for this year for the FREE nights (solid redemption for upcoming Asia/Thailand trip). Need to possibly reconsider.

Dawn, the new fee for the business SPG (Business Bonvoy) card will begin on your next renewal of the card after March 28th, 2019. The personal and luxury versions are staying the same. Check out more here!

Cam, you said, “…you’ll have the chance to earn a free night (up to 35,000 points) after $60,000 in annual spend.” Is that free night in addition to the anniversary free night?…or is the anniversary free night gone with the new card?

The free night after $35,000 spend is in addition to the annual free night! I’ve made it more clear in the post