Part of any good travel hacker is the concept of signing up for lots of credit cards. The idea, if you’re not familiar, is to sign up for credit cards, meet the minimum spending requirement, and then receive a fairly lucrative signup bonus.

(SEE ALSO: New limited-time 75,000 point credit card offer)

Some people have even been known to apply for multiples of the same cards

After you get the signup bonus, then generally you cancel the card, though there may be some cards where in addition to the signup bonus from meeting the minimum spending requirement, the ongoing card benefits justify keeping the card opening and paying the annual fee. For example, the Chase IHG credit card not only offers a large signup bonus, but each year when you pay the $49 annual fee, you get a free night at ANY IHG hotel, like the Intercontinental Bora Bora

(SEE ALSO: Why you should get 2 IHG cards at the same time)

My recent credit card signups

My most recent credit card signups included the American Express Ameriprise Platinum card, which at the time was offering no annual fee the first year and a signup bonus of 25,000 Membership Rewards points, after meeting a minimum spending requirement of $3,000 in the first 3 months. My 3 months is coming up, so I was wanting to make sure to meet the spending requirement to not miss out on the 25,000 points! I already had this almost happen to me, twice!

(SEE ALSO: 50,000 surprise American Express points)

(SEE ALSO: Do annual fees count towards meeting the minimum spending requirement?)

When there was a 2.25% bonus on American Express gift cards a few days ago, I bought $2,000 in business gift cards, which should have covered most of my minimum spend requirement. The 2.25% bonus should net me $45 in cash back, which would offset the ~$24 in fees from using that Amex gift card to buy 4 $500 gift cards at my local grocery store.

Problems with the minimum spending requirement ensue!

It had been a few days, and I had logged in to see the charge listed as pending. I checked again this morning, and the charge wasn’t listed at all. So I logged on and (finally) found an Amex live chat representative

(SEE ALSO: Easy trick to always get a live chat with American Express)

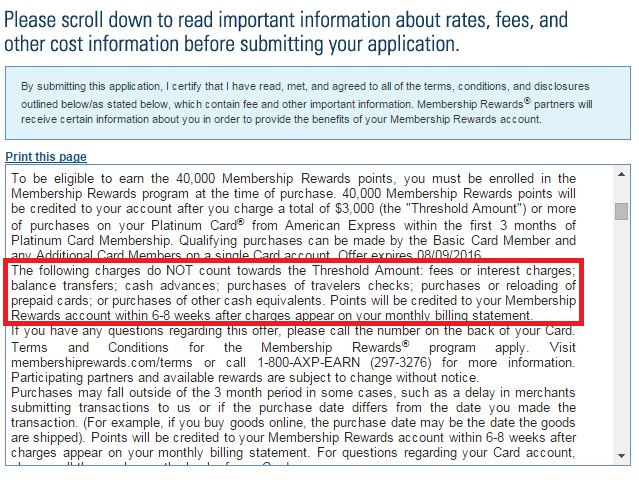

After a few pleasantries, the chat agent told me “Thank you, however it seems the Amex gift cards are one of ineligible purchases.”

This was the first I had heard about it, but he then told me there was a larger number of things that don’t count towards meeting the minimum spend requirement

- Interest charges / late payment fees / over-the-credit-limit fees / returned payment fees / foreign transaction fees

- Cash advances / Express Cash transactions

- Reloadable prepaid card purchases and loads

- Balance transfers / all purpose checks

- American Express annual membership fees / program fees

- American Express fee-based enrollment services

- Purchase of American Express Travelers Cheques and Gift Cheques

- PASS Card from American Express funds reload

- Savings deposits on Card

- Privileged Assets

- Transactions associated with Collision Damage Waiver (CDW) claims

- Federal Excise Tax Offset Fee

- Membership Rewards point redemptions

- Bulk Mail Charges with U.S. Postal Service

- American Express Gift Cards purchased online or at a TSO.

(emphasis mine, though I don’t know what a “TSO” is :-D). I also emphasized the about on reloadable cards, which I would assume that reloading with Serve would not count towards meeting a minimum spending requirement. I also checked through some of the current American Express offers, and found this in the terms and conditions

Thankfully, I still have a few days left to still get my bonus so I’m glad I figured it out now! In hindsight, it does seem to make sense, especially using an Amex to buy Amex gift cards. Have you ever been bitten by this? Did you already know the exceptions to meet American Express minimum spending requirement, or am I the only one?

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Hi, does this mean reloading on Serve won’t count?

Amex credit cards do not earn rewards when loading Serve, so I would not expect them to count towards meeting a minimum spending requirement

Are you sure about this claim, that Amex card loads of Serve do not count towards minimum spends???

You’re the first blogger I’ve read to claim this. By contrast, pretty sure I’ve read posts since May via dr. of credit, dans’ deals, mms, frequent miler, etc. — ALL suggesting that one of the remains virtues of Serve is the ability to meet minimum spends for new Amex cards.

(I even recall reading that some co-branded amex cards — such as with Fidelity — will also earn points/miles when loading Serve. )

I am definitely not sure about this but am only reporting what an official Amex rep told me. As I said upthread, it certainly wouldn’t be the first time that the actual terms and conditions were not QUITE how it worked in real life.

You are correct that 3rd party Amex cards do earn points / miles while loading Serve

I’ve met minimum spending requirements on two Amex cards by using Serve.

Thanks for the follow-up — and the chime in below Grant with your experience. I’m about to find out too — we re-opened a Serve account, just to help with an AMEX min. spend. I think some ambiguity may surround what is meant by re-loadable pre-paid card…. (Serve to some may seem in the category — but perhaps it refers more to the ole’ “Vanilla Reload” type products still out there — which don’t work for ms) Wil report back.

Can confirm now that 1k in Serve loads indeed did count in my family recently towards a 5k minimum spend. (for an amex MR bus card) Given the uncertainty, did intensify the spending into two months… just in case. In our case, turns out to have worked fine.

What do you mean the charge wasn’t listed at all? Did your order not get approved? I’ve successfully used buying Amex gift cards on a biz plat recently and currently did the same for this same card.

I think there were 2 issues. I may have a problem getting my gift cards, even though they show up as “Ordered” on the Amex gift cards site. But the bigger issue is that even if it HAD shown up on my regular Amex account, it would not have counted towards meeting my minimum spending requirement. I can’t confirm 100% that this is how it would have happened in practice, but I’m glad I found out BEFORE my minimum spending requirement period ended.

Some bloggers mentioned that while it is true that amex cards won’t earn miles on Serve but it could be used to meet min spending. But now it sounds like it won’t. Thanks for this info.

I can’t confirm 100% for sure, but I don’t think I’d risk it unless I heard more definitively

Is there any documentation from Amex that can confirm this?

Thanks for the heads up. Any idea if grocery store prepaid cards have a problem?

I would believe that would not be a problem. There’s nothing that is sent to American Express other than it was a $505.95 purchase at Kroger (or wherever). That is how I met my minimum spending requirement, so I’ll follow up in a few weeks when the bonus posts (or doesn’t!)

Did the bonus post? I am curious because I have a minimum spend on my spg amex and I want to be sure I get the bonus. Thanks!

Yes it sure did!

The prepaid gift cards I buy from CVS show up as “CVS Pharmacies” on my statement so I would imagine they’re qualified purchases but I could be totally wrong. Anyone can confirm?

Just like I said to Christian, I think this shouldn’t be a problem. The bank doesn’t know what the purchase at CVS was. Maybe you bought a lot of diapers and diabetes testing supplies 😀

Sorry, that was really unclear. Any idea if prepaid visa cards purchased from a grocery store would count toward the minimum spend?

TSO = Travel Service Office. You know the place where you used to go to exchange travelers cheques into local currency? You don’t see many of these in the US anymore. Even the long time office in San Francisco closed.

Thanks! Ahhhh traveler’s cheques… the good old days 😉

YMMV here. In May this year, I purchased 2k of AmEx gift cards online directly from AmEx to meet an AmEx Platinum 3k minimum spending requirement. I got the bonus and spent <4k total, so the gift cards definitely counted for me. I don't have the T&C handy for that card, though, so I don't know if they should have counted.

I first noticed this new addition to T&C in May 2015

Purchased $20K AMEX BIZ GC to entirely meet $20K Min spend on AMEX BIZ PLAT in June ’15. Received 150K bonus pts at stmt close.

Thanks to both Eric and you for the data points. Certainly this would not be the first time that a company representative didn’t know what he was talking about, nor the first time that the way things are actually coded / processed was not the same as the way the “official” terms and conditions stated… 🙂

For both Hilton Amex and Personal Rewards Gold Amex, loading money on Serve did indeed count toward minimum spending threshold. This was back in in May and June of this year.

I have personally got amex bonus by using Amex Serve online loads. But in June I met minimum spend of Amex Personal Rewards gold card with Serve and I did not get points. I opened a case and the case was closed after full 6 weeks of wait. They claimed that the Serve loads don’t qualify for MR points.