A lot of my enjoyment from writing this blog comes from helping people with travel questions. So many people have some miles and points, but the world of redeeming them is overly complicated, so much so that it can be overwhelming for people with only a casual interest level to make the most of their miles (that’s why the Capital One Venture card has all those commercials talking about “confusing world of miles that you can’t redeem”), even though the Capital One Venture card is not a great card IMO.

Reader Sunny wrote in asking about cards to use now that the Barclay Arrival card has been stripped of most of its benefit. My first question is always about WHERE you want to go – it’s always best to pick a travel goal first, and only THEN look at which cards can get you there. Sunny said:

We are about to start planning a road trip down the Baja Peninsula for next spring. There are so many ways to go about it I feel a bit overwhelmed at the options and how to narrow down the best use of points and money. Our trip will be about 3 weeks. We live in Seattle and its myself, my husband and 2 kids. I have mostly played around with Hotel credit card sign up but haven’t done any airlines yet.

One good thing that they have going for them is that they’re planning for 9 months out already. Remember The Traveler’s Triangle – the more flexible you can be with your dates, times or locations, the better chance you’ll have at getting a great deal.

Option 1: Amtrak

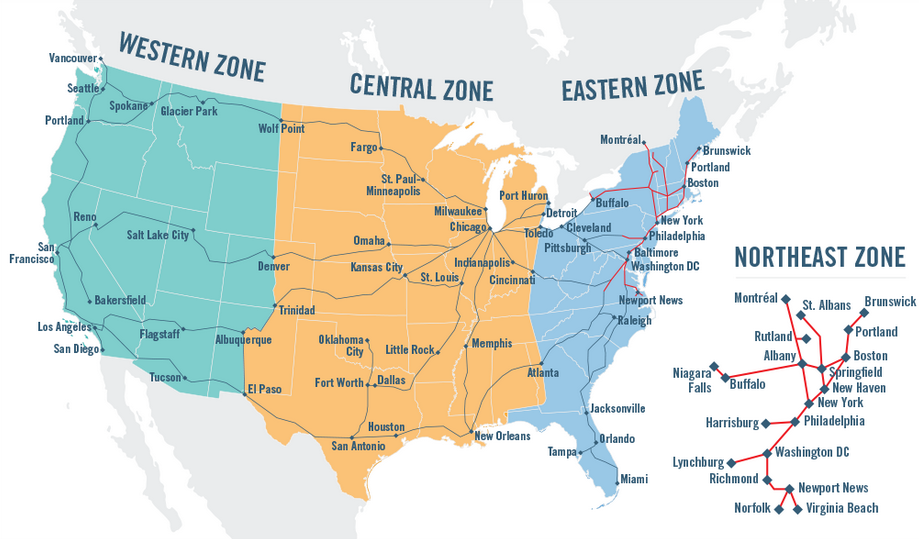

Going from Seattle to San Diego is actually one of the sweet spots on the Amtrak zone map

Because Amtraks zones run north-south, you can get a LOT of travel in if you take a north-south train, like the Coast Starlight that runs from Seattle to Los Angeles. Because it’s all in one zone, that’s a 35 hour trip for only 25,000 Amtrak points.

We had a blast on our Amtrak trip, but I did caution that I would probably only do the train one-way, on the return, as the 13 hour delay I had on my recent trip really put a damper on the start of our vacation.

Amtrak points transfer 1:1 from Chase Ultimate rewards as long as you have one of the premium Chase cards, like the Chase Sapphire Preferred or Chase Ink.

(SEE ALSO: Chase Ultimate Rewards: 5 reasons I think they’re the best miles out there)

Option 2: Alaska Airlines

Since they live in Seattle (an Alaska Airlines hub), another option is using Alaska Airlines miles. Sunny shared she already had some Alaska miles, and we talked about either flying direct to Los Angeles or San Diego, which would cost 12,500 Alaska miles, or flying with a connection to San Jose del Cabo, which would cost 17,500 miles

(SEE ALSO: 25,000 Alaska miles checking account offer)

(SEE ALSO: Alaska Airlines credit card with $100 statement credit is BACK!)

Option 3: British Airways Avios (to fly on Alaska)

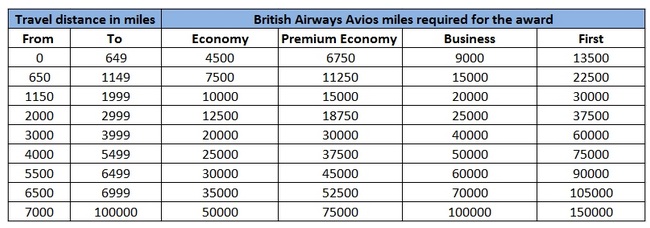

I shared the trick of using British Airways Avios to fly on its partner airlines (usually American Airlines but in this case Alaska Airlines as well). Because British Airways has a distance-based award chart, the cost in miles depends on the number of FLOWN miles for the flight.

Seattle to San Diego is 1052 miles, so this would only cost 7500 miles one-way per person. They could either then rent a car to go down the Baja Peninsula, or take a connecting flight to San Jose del Cabo (which at 804 miles would cost an additional 7500 miles per person).

British Airways points ALSO transfer from Chase 1:1 if you have a premium card (remember why I said Chase points are so valuable?!?). The current best offer for a Chase Sapphire Preferred gives 40,000 bonus points after spending $4000 in 3 months. You also get 5,000 points for adding an authorized user and having them make a purchase. So, coupled with meeting your spending, you’d be super close to getting the 55,000 Chase points that you’d need to fly a family of 4 down on Alaska Airlines one-way and taking an Amtrak train back up TO Seattle. If you are interested in the Chase Sapphire card, I do earn a commission if you apply through my link: Chase Sapphire Preferred.

I hope this helps, and if you have questions about your own situation, feel free to email me at dan at pointswithacrew dot com!

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Your Avios chart does not reflect the recent devaluation.

Thanks – you’re right. Still should be correct for economy flights, which is what we’re talking about here.