My intentions with this post is not to turn this into some sort of brag about how awesome I am, nor to turn it into a competition of who has the “most” miles (in fact, as you’ll see later, having a huge mileage balance is not ALWAYS a good thing).

Instead, I was just wanting to share a bit about what can be accomplished in a short time, starting from a zero mileage balance.

Where it all began

I’ve been aware of “travel hacking” and “app-o-ramas” for several years, but never really took the time to get involved. That all changed back in the summer of 2012. My family has a bi-annual family reunion in a different part of the country, and at the 2012 reunion, it was decided that the 2014 reunion would be at Lake Tahoe. I knew that the cost of 8 cross-country plane tickets was going to be expensive, might not fit in our family budget, and could be the difference between us being able to attend or not.

So I started doing some researching about the miles and points “game”, and after a few months, completed my first ever credit card signup in January 2013.

This led to us using 170,000 Southwest Rapid Rewards to fly our family of 8 for that vacation

Fast-forward to today

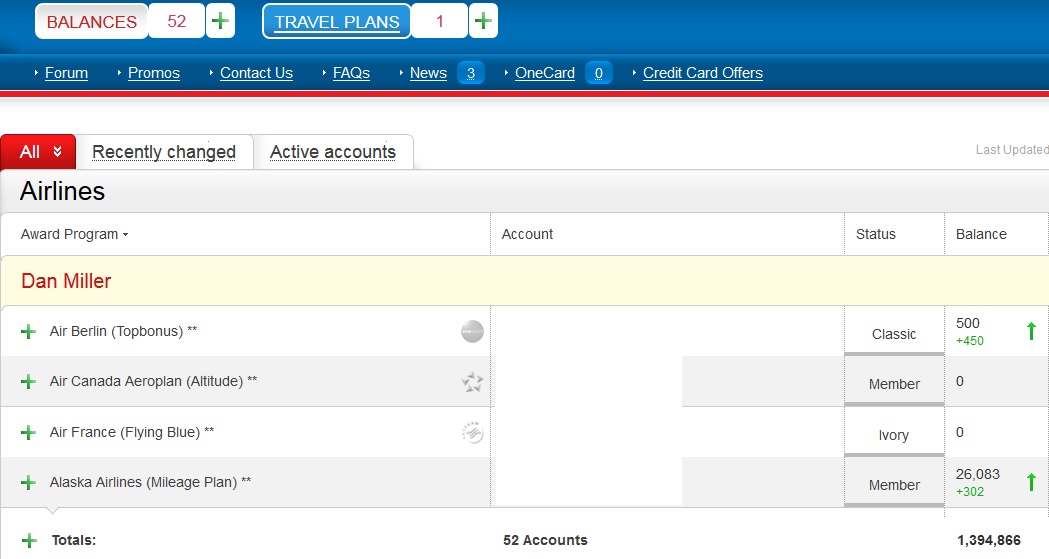

So now, a little over 2 years later, between my wife and I, we’ve gotten our combined mileage balances to about 1.3 million miles and points.

We use Award Wallet to track things – I’ve written about it before and I definitely recommend it as a way to keep track of your different accounts

How we did it

We’ve gotten those million points through a variety of ways. Here are some of the top ones

We’ve gotten those million points through a variety of ways. Here are some of the top ones

- Credit Card signup bonuses – by far this is the most lucrative. We regularly apply for new credit cards, primarily to get the signup bonuses.

- Regular spending on credit cards – Most of our spending is done to meet the spending requirement on new credit cards, but we do also put all of our regular every day spending on our credit cards.

- Reselling – Sometimes when there are huge bonuses (29x spending? 19x spending?) I have bought things and then resold them (mostly on Amazon). Most of this is due to spending through shopping portals.

- Manufactured Spending – I don’t do a ton of manufactured spending, but I have done some.

Why having a million points isn’t always the best idea

So, we’ve talked before in our article about “The Basics” (part of the Beginner’s Guide to miles and points) about how miles and points are a deflationary currency.

You don’t want to carry a huge balance but instead use those miles and points for trips. Earn em and Burn em baby! In addition to the 170,000 Southwest points we used for our family vacation to Lake Tahoe, we’ve used our miles and points to go to Miami, and Puerto Rico, and we’ve already booked a $6500 train trip on Amtrak this summer (cost in points? 100,000 Chase Ultimate Rewards). We’ve planned our trips for 2015 and we’ve got some exciting things planned!

What about you? What are some of your best tips for earning miles and most importantly also USING them? Let us know in the comments

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.