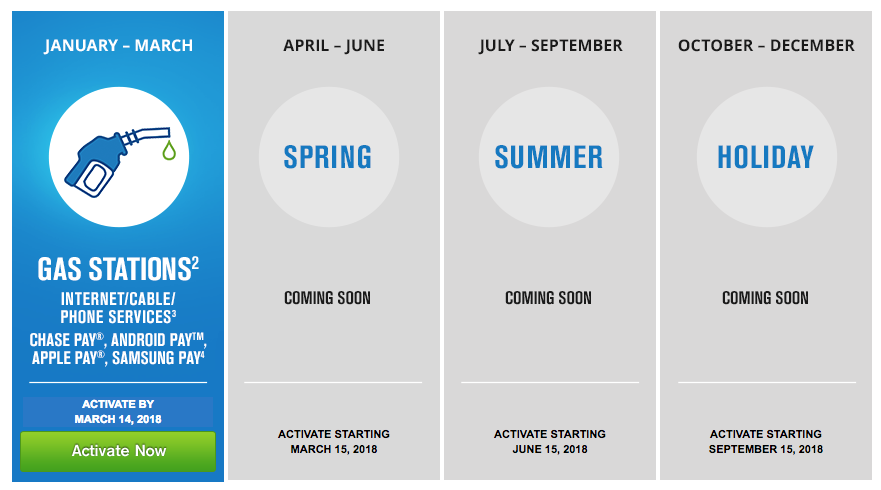

This is almost too easy. As seen in Doctor of Credit’s post, for the 2nd quarter of 2018, the upcoming bonus categories for Chase Freedom include:

- Groceries

- Chase Pay

- Paypal

We’re seeing a trend here. Chase has been pushing the use of Chase Pay since late last year. There were also Chase Pay bonus deals with Best Buy purchases early this year. Few things to remember about these quarterly bonus categories:

- Offer is available to Chase Freedom cards only, not Chase Freedom Unlimited

- Offer must be activated, and will be effective from April 1, 2018 – June 30, 2018

- You can earn 5% cash back up to $1500 worth of combined purchases per quarter

Coincidentally, Discover is also offering 5% cash back bonus when you use your Discover card for groceries during the 2nd quarter. What I like about these quarterly bonuses, they’ve been quite easy to fulfill. If there are any changes or updates to this offer, we will keep you all posted.

Have you taken advantage of these quarterly bonus categories from Chase and Discover? What has been your favorite?

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

That’s it? That’s the entire post?

It seems to me that the Chase points would be better than the Discover cash back. That is if you have another Chase account that allows you to use the points. Could you please explain that for me and your other readers please?

Good question and observation. With 1 Freedom card, you can only earn cashback on purchases that go up to $1500, anything beyond that will earn 1% during the quarter. But if you have other Chase Freedom cards in your household, like in my house, I believe, we have 3 or 4 Freedom cards, we increase our chances in earning more points or cashback. The best way to get the Freedom card WITHOUT applying for the Freedom is for those who think of downgrading their CSR or CSP to a no annual fee card. Before embarking on that decision, make sure you have plans to care for any points you’ve earned with your CSR and CSP – because any points earned with Freedom will not be transferrable to partner airlines.

If and when I get a new csr card, will I be able to use my accumulated freedom points to transfer or use?

Yes..you may transfer your Freedom points, or any UR earning points that you have to your future CSR card. Your points will get a better return you use your accumulated points once they’re in your CSR account. Just need to make sure that your CSR and Freedom accounts are all listed in the same household.

Aside from Best Buy, Chase Pay seems to have very limited reach. Does anyone have suggestions of ways to accelerate spend for these last few weeks of Q1?

You can now also pay for your gas at Shell stations using Chase Pay. I wrote an article on that just recently https://www.pointswithacrew.com/earn-35-cents-per-gallon-chase-pay-shell-stations/

For the 2Q bonus, Walmart online also allows Chase Pay for purchases.

Thank you Jason. My challenge for Q1 specifically is a lack of Chase Pay merchants. Using it at Shell would ultimately be no more effective than just using my Freedom card at Shell or any other gas station for that matter.

Remember, you can also pay for your cell phone bills, internet phone bills, cable bills for the remaining of the 1st Quarter. Not sure if you’ve already done that.

For the last few weeks of Q1 it’s all mobile payments. Google Pay, Apple Pay too. That should help “accelerate”.

Correct….and also, Internet, Cable, Cell Phone bills are all covered. Be careful with buying phones or accessories. Those, for some reason, in my experience weren’t part of the deal even though, at the time, I had bought directly at wireless store.

My Sapphire card gives me x2 for travel. If I use that card to pay Paypal will I get x7 or x5?

Good question. I’m thinking the max would be 5x, unless there’s a data point out there that would say otherwise. Do you have big travel plans in the 2nd quarter? Is it something that you try and pay a portion using Paypal and see what results you get? If I see other data on this, I’ll let you know.