Now that you’re familiar with the basics, let’s get started with something of a sophomore class.

Bank account bonuses can be very lucrative, but there are definitely some pitfalls to avoid. Remember, this is Level 2, not expert level. I’ll go over what I consider the intermediate information, and I’ll be happy to help with any questions in the comments!

You won’t be raking in millions with your bank account bonuses, but you can make some decent side hustle cash!

Geographic Restrictions on Bonuses

This is one of my biggest hurdles to finding great bank account bonuses. Living in Massachusetts, we have a lot of great credit unions and regional banks, but plenty of great bonuses are nowhere to be found in the Commonwealth. No Citi, no Wells Fargo, no Chase, no M&T, no SunTrust, no DCU, no HSBC…you get the idea. If there’s a geographic restriction on an account bonus, it’s usually one of two things: Either the bank restricts your application by address and zip code, or you’re required to go in branch to open the account.

If the account bonus is restricted by address or zip code, you’re usually out of luck. I’ve never tried to get around this, as I’m preeeetty sure it constitutes fraud. I am not a lawyer, but I still don’t recommend it.

Opening in branch is easy! (If there’s a branch near you.) There’s often similar restrictions on lucrative credit card bonus offers, so I’m sure you’re all familiar with the drill. Even though we do everything online in this glorious technological age, you’ll have to actually go in person and talk with someone.

GASP! You mean I need to leave the safety of my keyboard??

Yes. (Says the guy typing on his keyboard right now…)

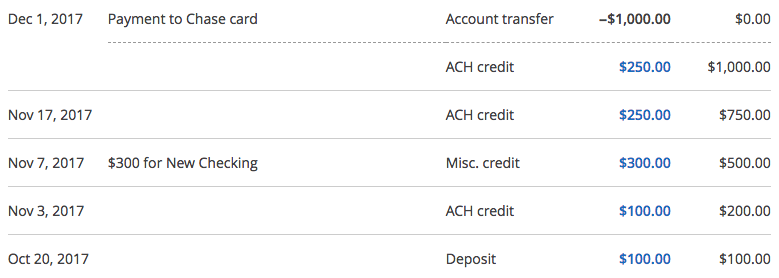

Luckily those of us in the miles and points world tend to travel quite a bit, so you may find yourself near a branch you need to visit. Last year, while attending the Chicago Seminars, I made sure to swing by a Chase branch in downtown Chicago for their $300 checking bonus promotion. I flew into Midway and wandered downtown for a bit, stopped by Chase, and left with a new checking account! A few weeks later, Chase deposited $300 into my account after I met the direct deposit requirements.

For the Chase bonus, I redirected a portion of my employer’s direct deposit to the account, and earned the $300 bonus shortly after my first employer deposit hit. I’m $300 (pretax) richer!

Credit Card Funding

Credit card funding is a great way to combine signing up for credit cards with bank account bonuses! Some banks (not all) allow you to initially fund your new account with a credit card. When opening online, it’s very convenient to plug in your credit card number and “check out” just like you do at Amazon. Most banks have a limit, some only allow $100 to be funded via credit card, some $1,000 (a nice boost to your minimum spend requirements if you’ve opened a new card recently!)

PLEASE BE CAUTIOUS WITH THIS TACTIC. I can’t stress this enough. There are a number of things that can go wrong (or at least be annoying). From most to least impact:

- Cash Advance Fees. I’ve heard plenty of folks try to fund a checking account with their credit card, only to have their card issuer hit them with cash advance fees for doing so. Honestly, we can’t really blame the card issuer here, you’re using your card to fund a bank account, and then you could go right over to the bank the next day and withdraw cash. I’ve got two recommendations. One, do your research. Sites like Hustler Money and Doctor of Credit will have some great data points on this stuff. Two, call your card issuer and ask them to reduce the cash advance limit (to $0 if possible), which brings us to the next issue.

- Your credit card issuer will block the transaction. Usually this is caused by that lowered cash advance limit – which is good. If the transaction tries to code as a cash advance and exceeds your cash advance limit, the credit card will block the transaction. The transaction can also fail due to fraud, etc.

- The card you wanted to use won’t be accepted. Some banks will let you fund with a credit card, but only certain networks. Likewise, not all card issuers will let you fund at certain banks. It will take some research to figure out which cards work with which banks. This can be frustrating, particularly when the bank only allows you one shot to fund the account.

- The bank will deny your account. Occasionally, you’ll open the account, punch in your funding details, and everything looks good…only to find out you’ve been denied the account the next day. The funds will get pushed back onto your card, and you’re not any worse off than when you started. Nothing ventured, nothing gained, right?

Tax Implications

I’m going to assume here, that the average person doesn’t typically receive a 1099-INT. And I’ll also assume that I may have just scared a few of you off with this heading. TAXES?!? Yes, we’ll talk briefly about taxes, but it’s easy stuff! Please remember, I’m not an accountant or tax professional in any way.

Banks issue 1099-INTs to anyone that has accumulated more than $10 of interest in a calendar year across all of their accounts. With account bonuses almost always $100 or more, you’ll be getting one of these forms. When you receive the form, you’ll have to claim that amount is income on your taxes for the year. Any cash bank account bonus will be treated as interest. If the bank account bonus is something else, you might be off the hook. I’ve seen some banks offer airline miles or gift cards as a bonus, instead of cash deposited to your account.

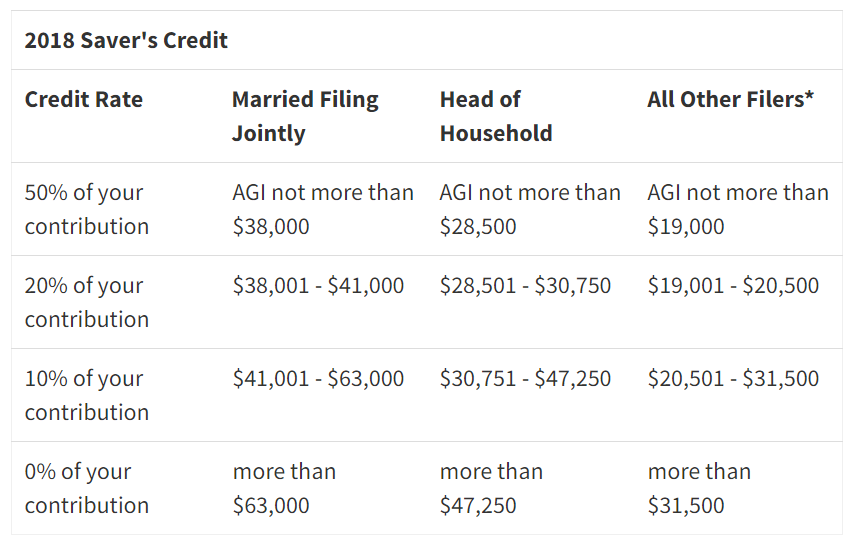

I’ll contend that the bank account bonuses are virtually always worth the tax hit, but you should definitely do your research and make sure. Keep an eye on your cumulative account bonus income (the total of all your 1099-INTs). Be sure you aren’t going over any thresholds in the tax code that are important to you. A good example might be the Saver’s Credit. If you’re cashing in on the bonuses, and your 1099-INT income for the year pushes you over one of these limits, that $100 account bonus might not be as valuable as a 20% credit on your retirement contributions.

AGI stands for Adjusted Gross Income, which would include Interest Income. Be mindful of thresholds like this, where a $100 bonus might not be worth the hassle. Talk to your tax professional regarding your personal situation.

I hope this information is helpful for everyone! I’m no expert, but I’ll be happy to answer any questions I can. Let me know what’s holding you back from cashing in on bank account bonuses in the comments!

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

I like the post. A lot of people don’t realize how good these offers can be especially to pay annual fees on some credit cards

Glad you enjoyed the post! I find the bank account bonuses very lucrative, definitely a great way to offset the annual fees on some of my cards if I can’t get a retention offer.