Long-time readers of PWaC will undoubtedly already know about the Chase 5/24 rule, which basically says that if you’ve applied for 5 cards from ANY bank in the past 24 months, you are extremely unlikely to be approved for most Chase cards

[Overturning Chase 5/24 – here’s how I did it]

[The 2 different types of cards not subject to Chase 5/24]

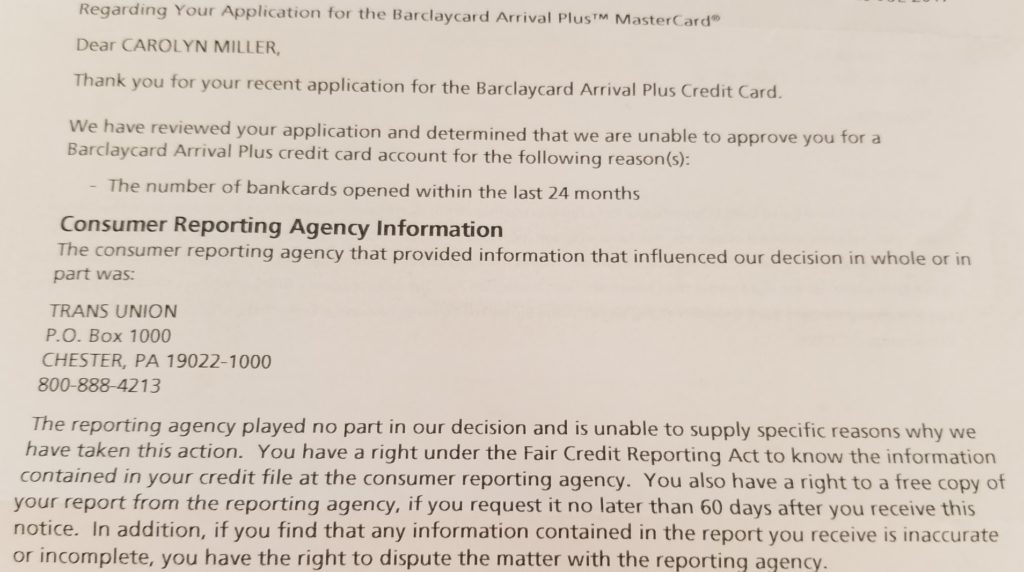

Application for a Barclaycard Arrival card

A few weeks ago, “my wife” applied for a Barclaycard Arrival card. She has had the Arrival card before but it’s been awhile and she does not currently have one. She got a “pending” notification and then a few days later after checking the Barclaycard reconsideration phone number and website, it said that she had been denied, and notification would come in the mail.

And here we go

She was denied for “the number of bankcards opened within the last 24 months”

The new 5/24?

I don’t know that I would call this a “new 5/24 rule” or anything like that, but it seemed clear that Barclaycard is checking the number of cards opened as a data point for people opening up new cards.

Someone on our free miles and points Facebook group asked how many cards she had opened up in the past 24 months and the answer was …. “I dunno” (SEE ALSO: Finally getting a handle on our 43 credit cards). It hasn’t been too many Barclaycard cards – I think just the Aviator and another Arrival card several months / over a year ago.

Any other datapoints?

I would be curious to hear from any other data points from people that have applied for the Barclaycard Arrival card or other cards from Barclaycard.

If you want to apply for the Barclaycard Arrival Plus card, you can find it on our list of top travel credit cards under featured travel credit cards. As of the time of this post, the bonus was 50,000 points after spending $3000 in the first 3 months. This is worth $500 if redeemed for travel and is the highest bonus that I have seen on this card.

Any additional data points for being denied by Barclaycard for “too many cards in the last 24 months”?

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

“my wife”

very respectful.

He says that because he is “the wife”, he opens the accounts in her name.

Correct.

I just got approved for the wyndham CC yesterday, and i’m WAY over 5/24.

I’ve always been auto-denied from barclay, and i’ve always gotten approved by calling into reconsideration.

Thanks for the datapoint – we’ll probably call in at some point but it’s such a hassle for her to call in – it is definitely an increase to marital discord :-). I also was approved this morning for the Wyndham card and am also way over 5/24

Doesnt make sense, Chase denied me due to 5/24, yet that same day Barclay approved my Wyndham CC app immediately, had it once before many yrs ago. Got the no fee card

The only Barclay card denials I’ve had have been overturned by calling in. Always on relation to amount of credit extended.

However, I just got a similar letter from BofA about my Asiana card app…

Same thing happened to me a few weeks ago. Tried calling in and specifically asked how many was “too many” and didn’t get any clarification.

Same exact experience here November 2018. Really want to get that new high bonus so I’m looking for answers now. I called the reconsideration line, they were very nice and tried to get me reconsidered but then they had to contact some other department the name of which Escapes Me Now and those guys we’re just rude and shut me down. Too many applications. We’re done talking to you. Goodbye. Called back a few weeks later hoping to get a different response, same thing. Nice reps, had to transfer me to that other department, they said they had already talked to me and had nothing more to say. Goodbye. I’m way over five and 24, but only ever opened up twp Barclaycards, the arrival plus which I downgraded to avoid the annual fee but didn’t cancel and still put charges on occasionally, and the Aviator red card which I barely used except to get the use it once for a bonus swipe. I had been using it in the month or two leading up to applying though expressly to get more action on it. Pretty stumped at this point.

Was recently denied for the Arrival+ for the same reason. I’m at 12/24. No previous Barclaycard relationship. Rep wouldn’t budge when I called recon.

I just got approved for the Lufthansa card. It was initially pending and I called in a few days later and it was approved after moving credit. I’m way over 5/24

I’m over 5/24, but just got approved for Jetblue Plus card over the last few days. This is my first Barclay card and got instant approval. I was at 8/24 at the time.

Barclay is famous for this. I got approved for the Wyndham card yesterday and the Aviator a few months ago. However, I was declined for the Aviator when it first came out due to too many recent inquiries. I’ve also heard that Barclay won’t approve you for more than 2 of their cards in a year. I’ve never heard of any hard and fast rules with them like 5/24, but they will decline more than most banks.

Well with Chase 5/24, Amex once per lifetime and Citi’s 1/24 per card family, I’ve got to imagine Barclays and Bofa are probably getting slammed with apps from churners. It was probably only a matter of time before they realized they needed to get tougher too.

I applied for the Barclaycard Arrival Plus and when I was rejected I immediately called their reconsideration line. It was explained that I had too many new credit cards in the last 24 months. It a lengthy call. I asked how many is too many? I was told that there was no absolute number of cards that would be too many. They said that if I applied in a year’s time I would be fine. They said that this criteria only applied for the Barclaycard Arrival Plus, but not to their other cards. As I had phoned reconsideration on the same day as my application, I turned around and applied for the Wyndham Rewards card that same day, and was accepted without delay.

That sounds like exactly what is happening to us

Sounds like you need a job.

Seems Barclays is just tight with approvals for the Arrival + card since it’s their own card compared to their co-branded cards.

co-sign that 2 Wyndham cards got approved last week for myself and wife and we were both LOL/24.

we each still had the Arrive+ card open at time of application (although reduced the credit line), and had had the Hawaiian and the AA Aviator cards from Barclays in last year as well (and those were cancelled before annual fee).

In fact wife was approved instantly, whereas mine took 4 days to get approval– I did not call in, but I’m assuming a human looked at it.

So, my guess is that the Arrive+ card is the hardest to get now from Barclays but the co-brand cards are treated differently

I applied for the Arrival Plus last week and was approved, that approval gave me 8 new cards in less than 6 months so we know 8/6 isn’t too many which makes me wonder how many cards some of you have gotten in the last 6 months lol. Of course they pulled TransUnion which pull wise helped me, only had 4 and my score was 760. Hope that helps. I’d say if you were turned down with less than 8 new cards in the last 6 months they aren’t telling you the real reason.

I had much less than 8 in the last 6 months. I was at 2/12 (excluding business cards). As I pointed out to them. But, as they pointed out, I had many, many more in the previous 12 months. They were considering the whole two years. I was at 10/24 (excluding business cards), with a rating north of 800.

Not sure what to think of that as I said I’m 8/6 and 11/24 with a score south of 800 at 760. I’m still going to stick with I don’t think they’re telling you the real reason although I’ve heard that Barclays is a hard issuer to figure out. A lot of their decisions don’t seem to have any rhyme or reason to them.

Extra Data Point:

Last card opened 7/19, and about 15/24. Got denied around 4 months ago applying for Red Aviator. Today I woke up to the news of the 60k AA points offer on 1 purchase back. So I tried, and guess what? THEY APPROVED ME. With a $1500 credit line, which I don’t honestly care.

Try again today Dan!

Just got denied for A+. Had closed my A+ on March 1st. Am at 14/12. Have not called yet, but reading all of your comments makes me pessimistic.

Last month I applied for 2 cards: 1) Barclay Arrival card – was denied for the same reason you mentioned. 2) However, I was approved for the (World of ) Hyatt card from Chase with the 40k bonus points for $2k spend. I later counted I had 9 new credit cards in the last 24 months before applying for the above two. So the Chase Hyatt card was an exception to the 5/24 rule?

“My wife” tried opening an Arrival+ card a few weeks ago and we got the same rejection. She has only opened one new personal card in the past year but is an AU on most of mine, probably another 6 cards or so.

Didn’t try the reconsideration line, although I guess can’t hurt to have the call.

Just got denied to Barclay business card (AA) for too many accounts open in last 2 years. I don’t utilize much credit, but do open a lot of cards. Oh well.