I’m a big fan of that one college basketball tournament going on right now whose name I can’t say for fear of violating their trademarks. Last year, we did a “Top Travel Tool March Mayhem” tournament where we ranked the top miles and points tool, with Award Wallet beating out AutoSlash in the finals.

CardMadness

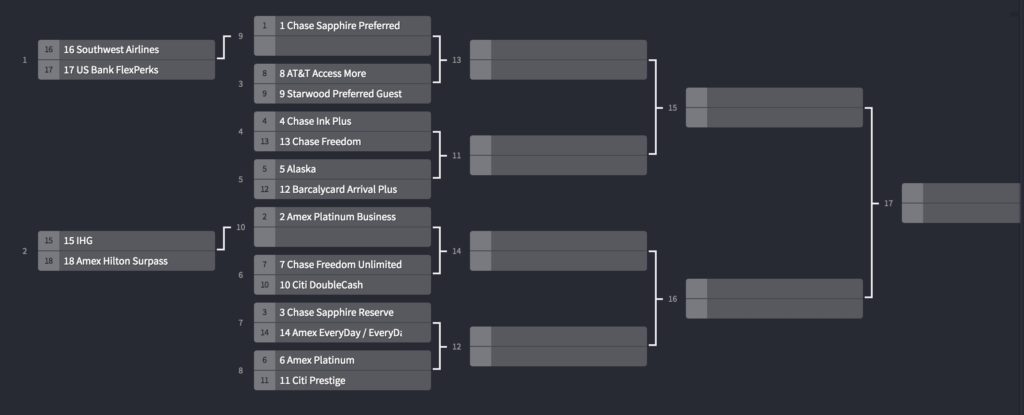

This year I thought I’d try a similar tournament to pick the “best” miles and points credit card. While the definition of a “best” credit card is fairly impossible to judge, since there are so many factors that go into that decision, most importantly figuring out where you want to go before you just sign up for cards, but hey, let’s give it a try!

CardMadness bracket

Here is our CardMadness bracket for 2017.

You could certainly argue with some of the seeds I’m sure, but I think it’s a fairly reasonable list.

Card Madness First Round

Our first round of card matchups will finalize the bracket. This is because I had a hard time knocking it down even to 16 cards. Even so, there were several cards that got left out of the bracket.

#15 Chase IHG® Rewards Club card vs #18 Hilton HHonors™ Surpass® Card from American Express

Our first matchup pits the Chase IHG® Rewards Club Select Credit Card vs the Hilton HHonors™ Surpass® Card from American Express

#15 Chase IHG® Rewards Club card – The big advantage of the IHG card is the fact that you get a free night on your anniversary, in exchange for paying the annual fee of $49. This free night (SEE ALSO: Why do people think “free” nights are a good idea?) is good at ANY IHG hotel worldwide, which is a huge advantage over some of the other cards that give free nights. If you are playing this game in 2 player mode, I usually recommend both you and your partner signing up for this card at the same time of the year. I would not generally recommend putting any extra spend on this card except maybe for paid stays at IHG hotels. The card also gives IHG Platinum status, which is not worth even breakfast at most places. Signup bonus has gone as high as 100,000 points though currently is at 60,000 plus a $50 statement credit. Although this card is issued by Chase, it is NOT believed to be subject to the Chase 5/24 rule)

#15 Chase IHG® Rewards Club card – The big advantage of the IHG card is the fact that you get a free night on your anniversary, in exchange for paying the annual fee of $49. This free night (SEE ALSO: Why do people think “free” nights are a good idea?) is good at ANY IHG hotel worldwide, which is a huge advantage over some of the other cards that give free nights. If you are playing this game in 2 player mode, I usually recommend both you and your partner signing up for this card at the same time of the year. I would not generally recommend putting any extra spend on this card except maybe for paid stays at IHG hotels. The card also gives IHG Platinum status, which is not worth even breakfast at most places. Signup bonus has gone as high as 100,000 points though currently is at 60,000 plus a $50 statement credit. Although this card is issued by Chase, it is NOT believed to be subject to the Chase 5/24 rule)

#18 Hilton HHonors™ Surpass® Card from American Express – The Surpass card comes with an annual fee of $75 and the signup bonus has gone as high as 100,000 Hilton points. This card gives 12x at Hilton properties, but the real magic of this card is the 6x on Hilton points at U.S. restaurants, at U.S. supermarkets, and at U.S. gas stations. That means a mere $833 of spend on the card at one of those bonused categories is enough for a free night at a Category 1 Hilton, which is the lowest of any card / chain. You also get complimentary Hilton Gold status and Diamond status through the next calendar year if you spend $40,000.

#18 Hilton HHonors™ Surpass® Card from American Express – The Surpass card comes with an annual fee of $75 and the signup bonus has gone as high as 100,000 Hilton points. This card gives 12x at Hilton properties, but the real magic of this card is the 6x on Hilton points at U.S. restaurants, at U.S. supermarkets, and at U.S. gas stations. That means a mere $833 of spend on the card at one of those bonused categories is enough for a free night at a Category 1 Hilton, which is the lowest of any card / chain. You also get complimentary Hilton Gold status and Diamond status through the next calendar year if you spend $40,000.

#16 Chase Southwest Airlines Rapid Rewards®vs #17 U.S. Bank FlexPerks® Travel Rewards Visa Signature® Card

#16 Chase Southwest Airlines Rapid Rewards® – The big benefit of the Southwest personal and business cards are the ability to get the Southwest Companion Pass, which you can get by earning 110,000 Southwest points in a calendar year. [3 ways to get the Southwest Companion Pass in 2017 without flying]. Bonuses on the various Southwest cards usually go as high as 50,000 or 60,000 points, with a $69 – $99 annual fee. These cards are not great for any additional spend after meeting your minimum spend and getting the companion pass. If you have a Chase Sapphire Reserve card (#3 seed), even spend on Southwest flights would be better put on a Chase card. [Does the Chase Sapphire Reserve make Rapid Rewards obsolete?]

#16 Chase Southwest Airlines Rapid Rewards® – The big benefit of the Southwest personal and business cards are the ability to get the Southwest Companion Pass, which you can get by earning 110,000 Southwest points in a calendar year. [3 ways to get the Southwest Companion Pass in 2017 without flying]. Bonuses on the various Southwest cards usually go as high as 50,000 or 60,000 points, with a $69 – $99 annual fee. These cards are not great for any additional spend after meeting your minimum spend and getting the companion pass. If you have a Chase Sapphire Reserve card (#3 seed), even spend on Southwest flights would be better put on a Chase card. [Does the Chase Sapphire Reserve make Rapid Rewards obsolete?]

#17 U.S. Bank FlexPerks® Travel Rewards Visa Signature® Card – FlexPerks is a different way to use rewards points – you can get up to 2% cashback, but only at certain tiers. For example, you can spend 20,000 FlexPerks to buy a flight worth up to $400. Signup bonus is usually around 20,000 FlexPerks, with bonuses for the Olympics. You also get 2x FlexPerks at gas stations, grocery stores or airlines – whichever you spend the most on each monthly billing cycle, and at most cell phone service providers

#17 U.S. Bank FlexPerks® Travel Rewards Visa Signature® Card – FlexPerks is a different way to use rewards points – you can get up to 2% cashback, but only at certain tiers. For example, you can spend 20,000 FlexPerks to buy a flight worth up to $400. Signup bonus is usually around 20,000 FlexPerks, with bonuses for the Olympics. You also get 2x FlexPerks at gas stations, grocery stores or airlines – whichever you spend the most on each monthly billing cycle, and at most cell phone service providers

A note on shenanigans – this contest is meant to be in fun and there are no prizes for winning. While I don’t mind if you encourage friends, family members and others to vote for a particular tool, please don’t try to rig the system by voting multiple times. I do reserve the right to disqualify entries and/or just arbitrarily pick a winner if I feel like it.

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Surpass provides complimentary gold status.

Yes – I think I mentioned that?

If you have an IHG card with Platinum status, you can ask Hilton to match your status, so you get free Diamond status.

That has happened before (I’ve done it twice), but I don’t know that I’d count on that going forward

You know…..the winners of these two matchups are just setting themselves up to be destroyed by the Amex Biz Plat and CSP.

Hey it’s just like the real tournament!!! 🙂

I know this is supposed to be all in fun, but on a semi-serious note, I have read and re-read the first “bout” between IHG World MasterCard and the Hilton Honors Surpass American Express card, and I have to say: I don’t get it.

If understand you correctly (and that’s a BIG IF), for an annual fee of $49 — which is certainly on the low-end of the spectrum — I can get Platinum status with IHG, 60% of the maximum sign-up bonus, ONE free night, a $50 credit (making the card essentially free), and no breakfast with IHG. In contrast, with the Amex card, I have a slightly higher AF ($75, but that’s lower than the Citi Hilton card), I get Gold status w/Hilton (which actually gets you something), I can get 75,000 points¹ as a sign-up bonus (75% of the max. offered), more bonus categories on spend than the IHG card, meaning more points faster and thus more free nights . . . the ONLY negative that I have found to this Hilton card is that they *do* charge Foreign Transaction Fees — stupid for an international hotel chain; they actually *don’t* want you to stay in their hotels overseas? — but that’s what Chase Sapphire Preferred/Reserve, and Citi Premier/Prestige cards are for . . .

So could you explain to my thick skull why the IHG card is better?

__________

¹ In the FWIW Dept., when I received this card, I did get the 100k sign-up bonus.

IHG , hands down . Anniversary free nights , Holiday Inn Chiang Mai for only 10,000 points per night … and they gave us a suite without being asked .

Hilton : cramped little rooms , dismissive attitude , lots of points , no extras .

Next January we will probably use our anniversary nights at the Intercontinental in Bangkok and use points in Chiang Mai .

“[F]ree nights,” as in plural? How many nights do you get each anniversary? I thought it was only one, and what can you do with one? Do you fly to Chiang Mai for an overnight? ;^)

We each have our own tastes, of course, and preferences, and as Dan originally pointed out, “the definition of a ‘best’ credit card is fairly impossible to judge.” But I’ve not found Hiltons to be especially cramped — especially when compared to Holiday Inns.

The IHG card gets 5x per $1 spend when staying at an IHG property; 2x per $1 on gas stations, grocery stores, and restaurants; and 1x on everything else. In contrast, the Hilton Surpass gets 12x, 6x, and 3x, respectively. Now, according to “another network,” as of this month, IHG points are worth 0.7¢ each; Hilton, 0.6¢. So while IHG points are worth more, the valuation is 3.5¢ when staying at an IHG property; 1.4¢ at gas stations, groceries, and restaurants; and 0.7¢ on everything else. In comparison, with Hilton, the numbers are 7.2¢, 3.6¢, and 1.8¢, respectively.

Sorry, but for *me* (and it’s just my observations), the Hilton card makes much more sense . . . even considering the pesky FTFs — I just don’t use the card outside of the US, and make all of my Hilton stays overseas on points alone.

You get 1 for each anniversary, though personally my wife and I signed up at about the same time, so we typically use both our nights together on the same trip

Hi Jason , Glad you are happy with Hilton . IHG has consistently worked out better for us . We each have a Chase IHG card . However we will likely use our free nights at the more expensive Intercontinental in Bangkok so we can host some friends . When we return to Holiday Inn Chiang Mai we will use points and some cash for about a week or ten days .

I have never stayed at a Hilton in the USA nor a Holiday Inn . My impression is that the Holiday Inn Chiang Mai is tremendously different than the Holiday Inn about six blocks from our home . I know the service is several orders of magnitude better .

As I said , glad you are happy with Hilton . Maybe we just haven’t experienced one of the better Hiltons thus far .

I am one of the parties who has been affected by the dumba** 5/24 rule by Chase, despite a FICO of over 800 and no debt. Consequently, I have NO CHASE products and that means ANY Chase product is useless to me.

On the other hand, after having been with American Express for OVER 40 years, that relationship is priceless to me. Guess which cards will always win with me?

Until the neanderthals at Chase revise their stupid, short-sighted and outdated thinking, all their products are crap to me.

Judge , we were both well over 5/24 when we were approved for the Chase IHG and Chase Hyatt cards March of 2016 . I believe ( no guarantee ) those two cards are exempt from 5/24 . With a credit score like yours you could afford to gamble a few points to find out .

P.S. : I like American Express also .