Yesterday Marriott and SPG made a “big” announcement regarding the future of their loyalty programs. Ever since the news broke over 2 years ago that Marriott was buying Starwood, there has been speculation about what their combined loyalty program would look like. Later on, they fixed the transfer ratio as 1 SPG point to 3 Marriott points, and we walked through 3 reasons to transfer SPG points to Marriott and 4 reasons to transfer Marriott points to Starwood (instead of the other way around)

We’ve already given the basics of what changed, so check that out first if you haven’t already

(SEE ALSO: 5 things you need to know about Marriott and SPG combining loyalty programs)

But now I wanted to take a deeper dive on some of the changes as we continue our series on this change

1. Reduced earning on the SPG credit cards

This is probably the biggest one for many people. I know there has been a lot of people that feel that SPG points are “pound for pound” the best points out there and for many people they are one of the main cards for every day spend.

Currently the 2 SPG cards earn 1 Starwood point per dollar spent, with very few bonus categories. Because of the ability to transfer 1 SPG point to 3 Marriott points, you’ve essentialy been able to get 3 Marriott points for $1 spent. But now the new and existing SPG cards will only earn TWO Marriott points for every dollar spent.

(Compare top Hotel cards here)

We’ll have more information comparing the different credit cards later this week

2. Introduction of “peak” pricing at hotels

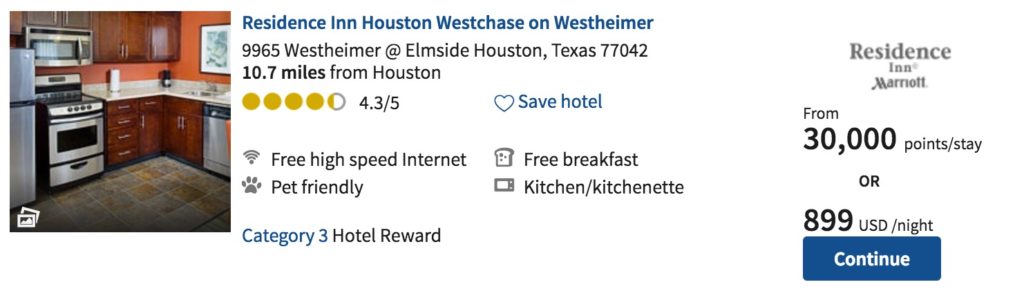

We still don’t quite know what it will like, but one change from the announcement was that hotels will now have off-peak, standard and peak prices. Even though the details are still a bit hazy, I’m sure that some of the outsized value that we’ve seen (like late December nights at ski resorts where paid stays are through the roof but award nights cost the same) will be gone.

It remains to be seen how sophisticated the IT system will be to see how the peak and off-peak definitions are – whether they will be more timeshare-y (red / white / blue weeks) or whether hotels will have the ability to define periods themselves (AKA “blackout dates”). It may no longer be able to score World Series hotel deals or Super Bowl hotel deals at the last minute (see below for one such Super Bowl LI deal!)

3. People who get status from anything but LOTS of stays

United elites (Gold and higher) get matched to Marriott Gold which is no longer very useful. Delta Crossover Rewards are going away. The statuses that you get from cards like the American Express Platinum card are only Gold. Even the premium SPG and Marriott cards are only giving out Gold (with a way to spend your way up to Platinum).

So unless you’re a true road warrior spending 50+ nights a year at Marriott hotels (at least!) you’re not likely to get a ton of value from status at Marriott.

What do you think? What is the thing that you’ll miss the most from the new Marriott Rewards program?

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

SNAs for Plat50 we’re cut by half, we don’t know how spg properties will be classified in the categories, plus and which worries me a lot: suite upgrades sound more like a perk you could be lucky to get but far from the best available room guarantee Starwood had. So it looks like an spg feature but poorly executed in a Marriott fashion. I already know some hotels out there that will not stick to this as a standard because Marriott is so lax about their policies (as in many others).

Somewhat this whole thing feels like they are trying to disguise themselves with spg looks – but remain the same mor(m)ons they always have been.

Shouldn’t #3 be “People who get status from anything but LOTS of NIGHTS,” since you can no longer qualify based on stays?

I think you get Gold from the Amex Plat, not Platinum

Yes – you are correct. Typo fixed

I read it like Miles — convert to [basically worthless] Gold from Amex Plat [bye-bye Marriott breakfast — bye-bye Marriott??], EXCEPT from Aug 1 to Dec 31 of this year when it appears your Gold gets converted to Marriott Platinum as a tease — but the same Gold converts to Gold at SPG from Aug 1 to Dec 31 [go figure — one program or not??] And then on January 1, Amex Plat gets Gold; and Gold next year ain’t the new Platinum.

There’s an awful lot to dislike about the new program, but you nailed some big points. Another is requalification becoming so much more difficult, between stays not counting and only a single room counting toward status. Also, suites going from a core benefit to a discretionary one means it will be rarely provided, if at all. Overall, I’m exceedingly unhappy with the new program

The big poop comes in Aug when they just slide the Marriott hotels level for level into the 1-8 levels. Those 45k hotels will be 80k soon.

Cr** I saw this as all good yesterday till this message. The big negatives, devaluation of credit card spend. My spend is easily 120K per year with my SPG card. I frequently have two rooms at a time which gets me my platinum status. I was concerned about the changing of point levels of the properties and what the redemption would be but this is all less exciting to me.

One question I still had with the airline transfer United is 2:1 plus the 5K when the new model hits will United be the same as other airlines of 1:1 since they have a relationship with Marriott now.

So, I get Gold Elite with SPG because I own 2 Westin Timeshares. I frequently convert the staroptions to starpoints. When I combined accounts with Marriott I was became a Gold Elite. But now it says I will be come a Platinum elite.(but only until 1/19?)

Then I will become a Gold Elite again unless I stay the required amount of nights?

That’s my understanding

Will the SPG points I already have earned transfer to Marriot as 3 points or 2?

James – in August, all SPG points will go to Marriott points 1:3

I’m 45,000 away from 2 million points and have 1025m nights. I was hoping to transfer points from SPG to get lifetime Platinum but someone wrote that the transfer points won’t count for lifetime status, correct? Thanks

Correct. But…if you can find someone to transfer 45,000 Marriott points to you (have to call) those *do* count toward lifetime. Fee is minimal.