Many people who like to collect miles and points are leery of “hard pulls” – where the bank or credit card company will do a hard pull on your credit. This is fairly standard with opening a new card, but there are 2 reasons to try and minimize your hard pulls

- Opening a new account does usually cause a (temporary) hit to your credit score

- Personal cards (and some business cards) will count against your Chase 5/24 status, possibly making you ineligible for some Chase cards.

(SEE ALSO: Overturning Chase 5/24 – here’s how I did it)

(SEE ALSO: The 2 types of cards not subject to Chase 5/24)

I generally have not been super concerned about the number of hard pulls that I get, as my credit score has remained in the high 700s regardless. I have not been that worried about Chase 5/24 either, though I’ve definitely slowed down my number of card applications over the past year or so.

American Express Hilton Aspire upgrade offer

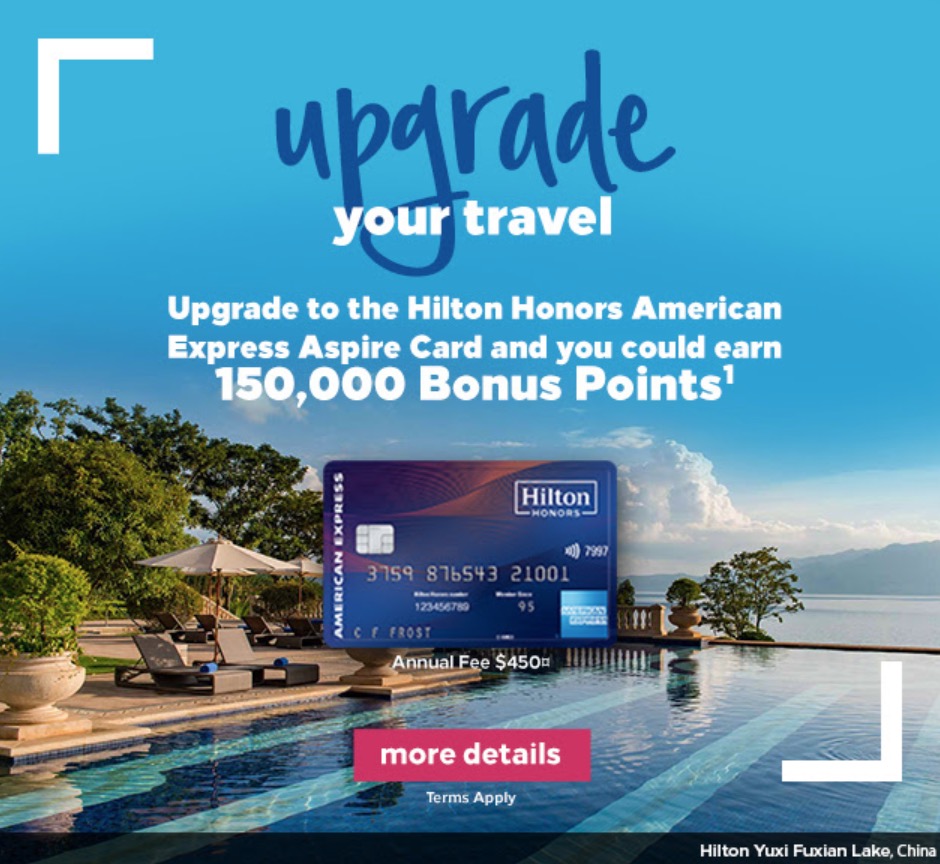

Still, the opportunity to pick up a full welcome offer WITHOUT getting a hard pull is an attractive offer. I got an email the other day from American Express about upgrading my current Hilton Ascend card to the (premium) Hilton Aspire card

It is also available in my account page at americanexpress.com.

Other holders of the Ascend card have reported it as well, so I don’t believe that this is targeted; I believe it’s available to anyone with a current Hilton Ascend card.

This matches the current welcome offer for the Hilton Aspire card which is 150,000 Hilton points after spending $4000 in the first 3 months.

Compare that to the Marriott Premier card (from Chase) – current cardholders were only given 20,000 or 30,000 points to upgrade. This is the full welcome offer given to new cardmembers instead of just a fraction like Chase did with the Marriott card.

Benefits of the Hilton Aspire card

The Hilton Aspire card does come with a $450 annual fee, which is pretty steep for a hotel card. It does come with a variety of benefits though which may make it worth it depending on your situation

- The 150,000 Hilton points I value at about $600

- Hilton Diamond (top tier) status as long as you have the card

- 1 weekend night reward when you sign up and every year after renewal. And, earn an additional night after you spend $60,000 on purchases on your Card in a calendar year.

- $250 airline credit per calendar year

- $250 resort credit at Hilton resorts and a $100 credit on a 2 night stay

- Priority Pass access for yourself and 2 guests (if you don’t already have like 5 Priority Pass memberships 😀 )

- 14x Hilton points when you stay

Other great welcome offers on Hilton cards

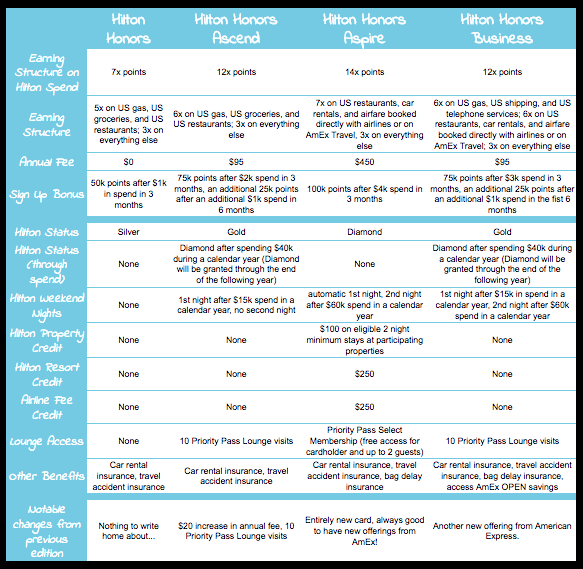

If you don’t have an Ascend card or aren’t eligible for the Aspire upgrade, here are the 4 different American Express Hilton offers with their current welcome offer

- Hilton Honors Card from American Express – 75,000 Hilton points after spending $1000 in the first 3 months. No annual fee. Learn more about this card by clicking here

- Hilton Honors Ascend Card from American Express – 125,000 Hilton points after spending $3000 in the first 3 months. $95 annual fee. A free weekend night after spending $15,000 on the card. 10 free Priority Pass lounge visits. Learn more about this card by clicking here

- The Hilton Honors American Express Business Card – This is the one (currently) with the big Hilton 125,000 point welcome offer. 125,000 Hilton points after spending $3000 in the first 3 months. You also get top tier Diamond status by spending $40,000 on the card in a year and the possibility of 2 free weekend nights with spend. This is a business card, though you may have a business even if you don’t really think you do. Learn more about this card by clicking here.

- Hilton Honors Aspire Card from American Express -150,000 Hilton points after spending $4000 in the first 3 months. $450 annual fee but plenty of benefits Learn more about this card by clicking here (not an affiliate link)

The 125,000 point offer on the Hilton Honors Ascend and the Hilton 150,000 point offer on the Hilton Honors Aspire are higher than we have ever seen. The other 2 offers (75,000 for the no-fee version) and 125,000 on the Business card are matching the highest welcome offers we’ve seen

Here’s a chart comparing the different options

If you’re looking for what to do with all those Hilton points, you can see our 5 best uses of Hilton points here. If you’re approved for a card through these links, I may receive a commission. As always, DO NOT SIGN UP FOR A CARD JUST BECAUSE SOME GUY ON THE INTERNET SAYS YOU SHOULD. If you have any questions, feel free to email me directly at dan at pointswithacrew dot com or ask your questions over on our free miles and points Facebook group

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

My upgrade offer is for zero points…

Same for my wife. I guess this is reverse targeting- everybody gets the 150,000 except those they target as unworthy.

Does an upgrade count toward 5/24?

No – it shouldn’t. You don’t get a hard pull to convert your account so nothing shows up on your credit report

I didn’t receive an offer either. In the last year, I’ve only spent 7k on the card as its made more sense to spend most of my spend on other cards.

Not sure where your belief that isn’t targeted is coming from? I have no such offer for my Ascend as others have reported. Might be time to revise that verbiage in your post….

I got this offer on my no annual-fee Hilton that I’ve had for years and put no spend on. Jumped on it.

I didn’t see an email but the offer was in my account when I looked for it. Think I will go for it and hope it doesn’t affect my 5/24.