If you’ve been waiting for a good time to snag a new Delta Air Lines credit card, now is the time to apply! Currently we’re seeing the highest bonus offers available on both the Amex Gold Delta SkyMiles® Card and the Amex Platinum Delta SkyMiles® Card. Let’s dive in and see what you can expect if you decide to sign up for one of these cards!

NOTE: These offers expire July 5th, so you are running out of time left if you want to apply. If you want to apply for either card and support PWAC at the same time, you can find these and other top airline cards here! (I may receive a commission if you apply through this link).

And again, as I always say, PLEASE DO NOT APPLY FOR A CREDIT CARD BECAUSE SOME GUY ON THE INTERNET SAYS YOU SHOULD! If you have questions about miles and points, check out our Beginner’s Guide or our free miles and points Facebook group.

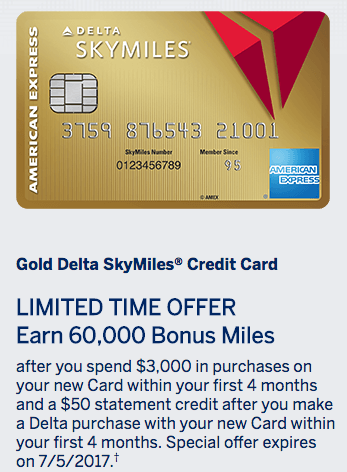

Amex Gold Delta SkyMiles® Card

Amex Gold Delta SkyMiles® Card

The first card is the Amex Gold Delta SkyMiles® Card which is offering a signup bonus of 60,000 SkyMiles after spending $3,000 within the first four months of opening the card.

In addition to the bonus miles, you’ll also earn:

- A $50 statement credit when you make a purchase with Delta Air Lines within the first four months

- 2 points per dollar on Delta purchases, 1 point per dollar everywhere else

- Priority boarding

- Free first checked bag for you and up to nine people on your reservation

- No foreign transaction fees

- $95 annual fee, waived in the first year of card ownership

Remember, AMEX cards have a “one bonus per lifetime” on their cards, so if you’ve had this card before, you’re probably out of luck.

(SEE ALSO: I just got a 2nd bonus on an Amex card)

If you’re a less than frequent traveler and want to avoid the annual fee in the first year, the Amex Gold Delta SkyMiles® Card might be the right choice for you!

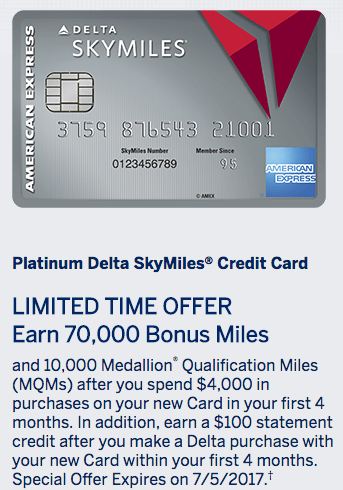

Amex Platinum Delta SkyMiles® Card

Amex Platinum Delta SkyMiles® Card

The other card with an increased signup bonus is the Amex Platinum Delta SkyMiles® Card. That one has a signup bonus of 70,000 SkyMiles and 10,000 MEDALLION® QUALIFICATION MILES (MQMs) after spending $4,000 within the first four months of opening the card.

In addition to the bonus miles, you’ll also earn:

- A $100 statement credit when you make a purchase with Delta Air Lines within the first four months

- 2 points per dollar on Delta purchases, 1 point per dollar everywhere else

- Discounted Delta Sky Club access

- Priority boarding

- Free first checked bag for you and up to nine people on your reservation

- No foreign transaction fees

- $195 annual fee, NOT waived in the first year of card ownership

The Amex Platinum Delta SkyMiles® Card also comes with ANNUAL MILES BOOST®, which earns you 10,000 (MQMs) and 10,000 bonus miles after you spend $25,000 on purchases on your Card in a calendar year. You’ll earn an additional 10,000 MQMs and an additional 10,000 bonus miles after you spend $50,000 on eligible purchases on your Platinum Delta SkyMiles Card in a calendar year.

Like above, AMEX cards have a “one bonus per lifetime” on their cards, so if you’ve had this card before, you’re probably out of luck.

If you’re a more frequent traveler and feel that the benefits of this card outweigh the $195 annual fee, the Amex Platinum Delta SkyMiles® Card might be the right choice for you!

Our take

Personally Carolyn and I have already both had the Gold card and since we’re not frequent Delta travelers at this point, the MQMs from the Platinum card are not appealing enough to offset the $195 annual fee. So we’ll be sitting this one out.

But I know there are many people that have already or are planning to apply, and if this is you, now would be a good time to do so! And if you’re wondering what you might do with all those Skymiles – check out 7 ways to spend 1,000,000 “worthless” Delta Skymiles

If you want to apply for either card and support PWAC at the same time, you can see top airline cards here! Through this link I may receive a commission when you apply for a credit card

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

You can find these offers until July 26th at the Doctor of Credit referral page.

Correct – I believe all refer a friend offers go through the 26th