According to Doctor of Credit, American Express is apparently sending out offers to holders of Hilton Honors or Hilton Surpass cards, offering bonus points for adding authorized users to either Amex Hilton card.

- Get 10,000 points per authorized user on the Hilton Surpass card after $1,000 spending; maximum 4 bonuses for a total of 40,000 points

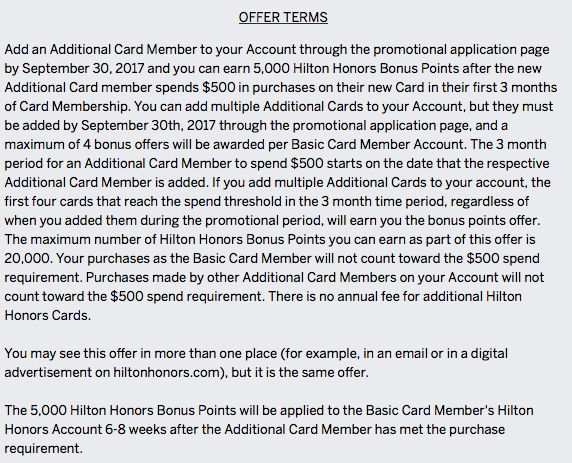

- Get 5,000 points per authorized user on the Hilton Honors card after $500 spending; maximum 4 bonuses for a total of 20,000 points

The spending requirement of each authorized user’s card must be met within first three months. While only some people received the offer, this link (log in required) seems to be working for everyone. I only have the no-fee Hilton Honors card and I was able to login to my account and reach the offer.

Terms of the offer for the Hilton Honors card are shown below. Note that you must add the authorized users through the promotional application page by September 30, 2017. The bonus points will be added 6-8 weeks after purchase requirements are met.

A word of caution – cards added will count towards Chase’s 5/24 for the authorized users, though you can often override that by calling in. And adding lots of AU cards may sometimes trigger Amex financial review. So do proceed with caution if you decide to take on this offer. While authorized users’ social security numbers and birthdays are not required at the time of adding, you still need to provide the information to Amex within 60 days of account opening.

I tried adding an authorized user but got the “sorry the card apply site is temporarily down” message. Not sure why and it seems that some people are getting the same message. If you able to go through the whole process and successfully adding new authorized users, let us know in comment below!

How to get the Amex Hilton or Hilton Surpass card

If you don’t have either of these American Express Hilton cards, you can still sign up for them. The offers have been as high as 75,000 Hilton points for the regular Hilton or 100,000 for the Surpass, but the current public offers are 50,000 and 75,000. You can still get higher offers through refer a friend bonuses however

- Amex Hilton Honors card – 75,000 Hilton Honors points after spending $1000 in the first 3 months. No annual fee on this card

- Amex Hilton Surpass card – 90,000 Hilton points after spending $3000 in the first 3 months. There is an annual fee of $75 on this card

If you sign up soon, you still should be able to add the authorized users by September 30th and get 95,000 points on the no fee card or 110,000 points on the Surpass card.

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

What’s the telephone number to call Chase so that I can add another user?

We are talking about American Express, and you shouldn’t have to call – follow the link in the post

But the post says, ” cards added will count towards Chase’s 5/24 for the authorized users, though you can often override that by calling in.” So I thought I’d try calling so that I can override the 5/14. Does that make sense? Should I call?

Gotcha. What that means is that if you have say 4 new cards and 1 authorized user card from any bank in the past 24 month, you will be likely be declined if you apply for most Chase cards, like the Chase Sapphire Preferred. If that happens, you can call in and tell the Chase rep that one of those 5 cards is an authorized user card, and they will likely approve you. See how I did it at Overturning Chase 5/24

I’ll need to do that. What’s the telephone number?

Chase reconsideration phone number – or you probably got a letter in the mail